It’s been another month of rate cuts as the easing cycle keeps rolling.

The RBNZ trimmed the OCR again this month – good news for borrowers, a bit tougher for income investors.

OCR update: continued easing

The Reserve Bank made a statement earlier this month with a 0.50% cut to the Official Cash Rate (OCR) and has signalled another 0.25% cut likely in late November.

Markets have that move fully priced in and are giving roughly even odds of one more cut in February 2026.

Our house view is that they should have made the 0.50% cut at the start of the easing cycle, not saved it for the back end - but better late than never.

Inflation’s still hovering near the top of the RBNZ’s target band, so the RBNZ must feel confident that the 12-month picture ahead looks benign for inflation and that it’ll stay in the 1 – 3% band.

What it means for your investments

I’ve recently published an article on how banks manage their interest rates at the bottom of the interest rate cycle, check it out here.

We’ve adjusted Squirrel investment and lending rates in line with the OCR change.

We know that stings a bit for investors who rely on interest income. But staying sharp on the lending side keeps quality loans coming through the platform – and without lending, there’s nothing to invest in.

The hot topic: queue times

Wait times on Term Investments are longer than usual.

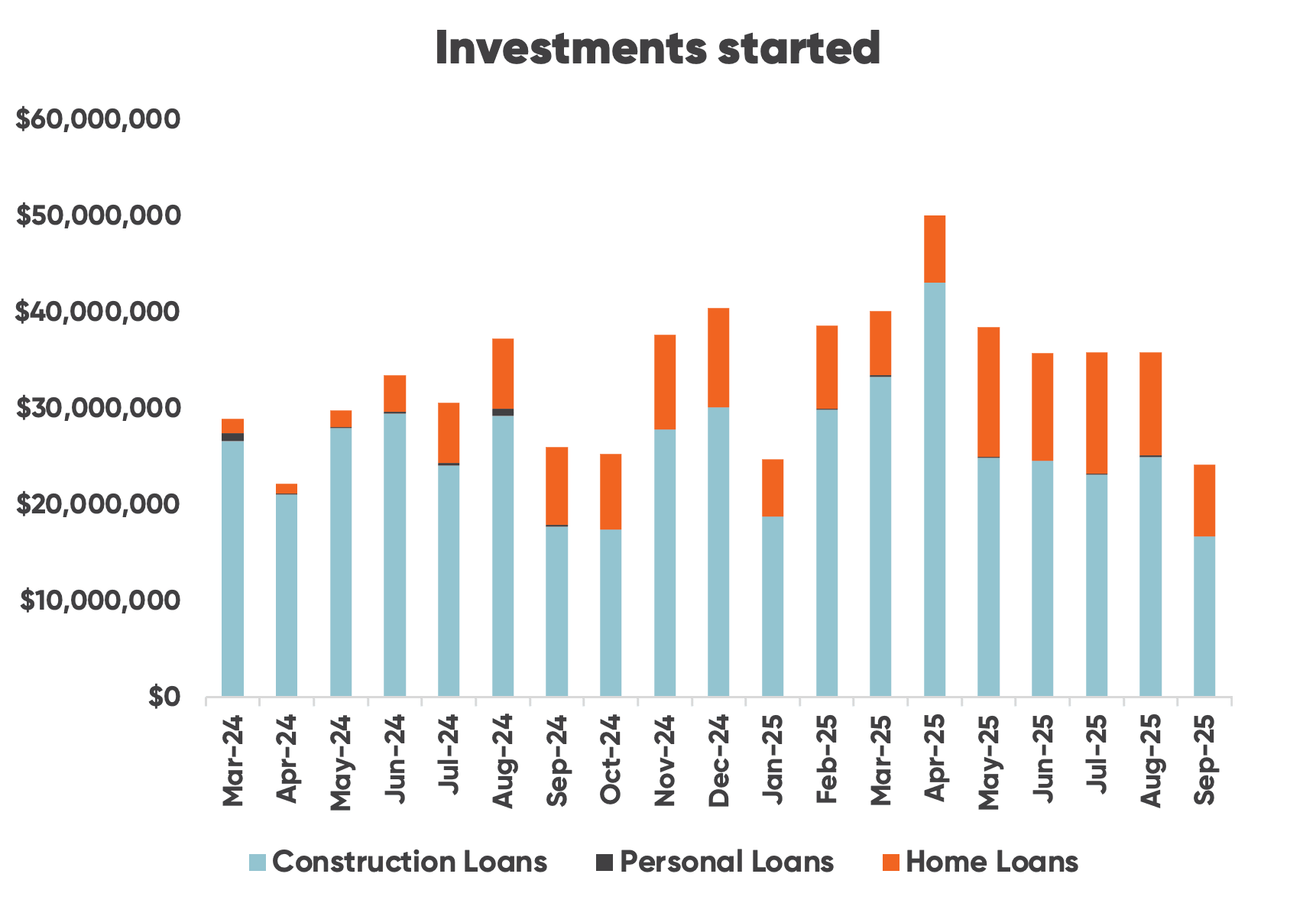

The chart below shows monthly investment starts over the last 18 months (October is mid-month data). These numbers reflect both new loans being funded and secondary market sales between investors.

Queues are a little longer than usual right now because:

- Timing: Fewer new loans have settled in the past six weeks – loan settlements do ebb and flow.

- Reinvesting: More loans have matured, and many investors have rolled straight back in.

- New investors and increased investment: We’ve seen a lift in first-timers joining the platform (great long term, a bit of a squeeze short term), and existing investors adding to their investments with Squirrel.

One thing we won’t do is loosen our credit standards to speed things up. That wouldn’t serve anyone well – not us, and definitely not you.

Looking ahead

October should finish with around $35m of new investments starting – so back to about the run rate of recent months (excl. September), with November tracking closer to $40m.

What you’re seeing right now is likely to be a short-term blip – we expect things to smooth out over the next 4 – 6 weeks.

Thanks for your patience and continued trust in Squirrel.

Questions, comments, ideas?

As always, I’m always keen to hear from you – let me know what we’re doing well and what we could be doing better. You can reach me on dave@squirrel.co.nz.