How good would it be to have a business where it took just a 2% increase in sales volumes to grow your income by 26%?

Well, that’s exactly what’s happened for BNZ over the last six months. ANZ was hot on their heels with a 21% lift income, with almost no balance sheet growth.

It’s called “margin expansion” – although a more apt description might be “margin explosion”.

All the banks will be reporting results like this, meaning they’re laughing all the way to the, well, bank.

So, just what the heck is going on that the banks are recording this sort of profit?

Let’s unpick the latest BNZ result to understand (although remember BNZ are not alone here).

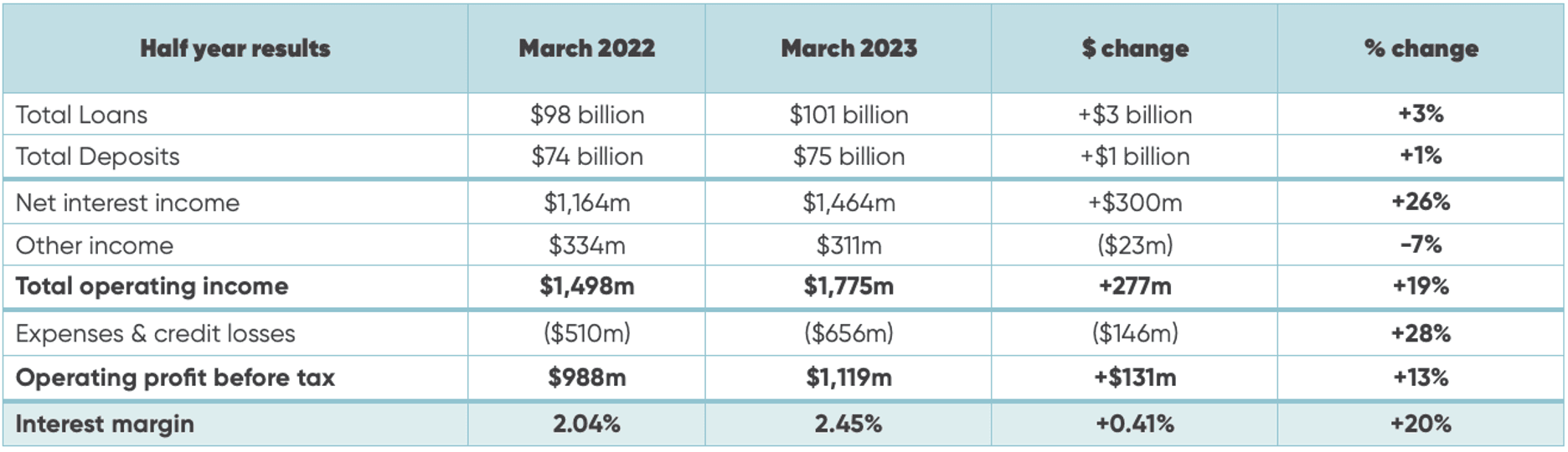

This table outlines how BNZ’s key profit metrics have shifted between March 2022 and March 2023.

You’ll want to pay particular attention to the last line.

In short, the reason banks have been able to report such enormous lifts in profits is because they've massively expanded their interest margin.

And how do they do it? Well, to put it bluntly, by taking from New Zealanders’ pockets - yours and mine – without us even realising.

They’re benefiting from our inertia.

Kiwi currently have about $44 billion sitting in transaction accounts – generally paying them something like 0% interest, or thereabouts.

The banks, meanwhile, are earning GOOD interest on that money.

At the very least, for the cash they’ve got on-hand, the Reserve Bank pays them a return in line with the Official Cash Rate (OCR). If they’ve lent it out to borrowers in the form of a home loan, credit card, overdraft, etc. they’ll be earning a much higher margin.

Over the last 18 months the OCR has risen by 5% - as have the returns the banks are earning on any transaction account funds kept on-hand.

And yet, they continue to pay 0% interest on your transaction account balances.

And THAT is the interest margin that’s making them so much money.

Here’s a graph of what our $44 billion of transaction account money is worth to the banks. You’ll note how it’s ballooned from $78m just two years ago when interest rates were low, to almost $2.3 billion today.

Source: RBNZ data, Squirrel

But that’s just the half of it.

Kiwi also have $75 billion sitting in savings accounts, earning an average interest rate of 2.64%. Here’s a graph of what that money is worth to the banks – another $2.1 billion, or thereabouts.

Source: RBNZ data, Squirrel

So, there you have it.

Kiwi inertia, as we leave money in transaction and savings account at zero or low interest rates is costing us. Big time.

About $1000 on average for each adult in New Zealand.

What can we do about it?

It’s simple. Move your money to a high yielding savings account, ASAP!

I’ve done the research stacking up the best and worst bank savings accounts in New Zealand – including how you could earn 5.00% per annum on your savings, with funds on call (held on trust in an account with a Standard & Poor’s AA- rated major registered bank).

Make sure you read it before you move your money, as the difference could cost you almost 3% in returns.