A few weeks ago, one of Squirrel's newer team members piped up about how they hate being stung with withdrawal fees on their bank-held savings account.

At the time, I had a wee chuckle and talked through why these charges exist. But the comment got me thinking about the way bonus savings accounts work in New Zealand—and how well they’re serving their intended purpose.

First up, how do bonus saver accounts work?

Bonus saver products have been around for decades. Unlike simple savings accounts, which have just the one standard interest rate, bonus saver products work on a two-tiered rate structure:

- The base rate—which you earn regardless of what you do with your money.

- The bonus rate—which you only get if you meet certain criteria over a specific timeframe (usually a month)

Conditions for earning the bonus interest rate differ from bank to bank but typically your balance must go up (usually by a specified amount) and you can’t make any withdrawals. Bonus saver accounts often also charge withdrawal fees.

The reason they’re designed this way is to incentivise customers to save regularly and deter people from dipping into their savings unless absolutely necessary.

It’s a behavioural economics approach to saving which we don't see a whole lot of in New Zealand (outside of bonus saver products).

To my mind, there's a major problem with the way bonus saver rates are structured in New Zealand today

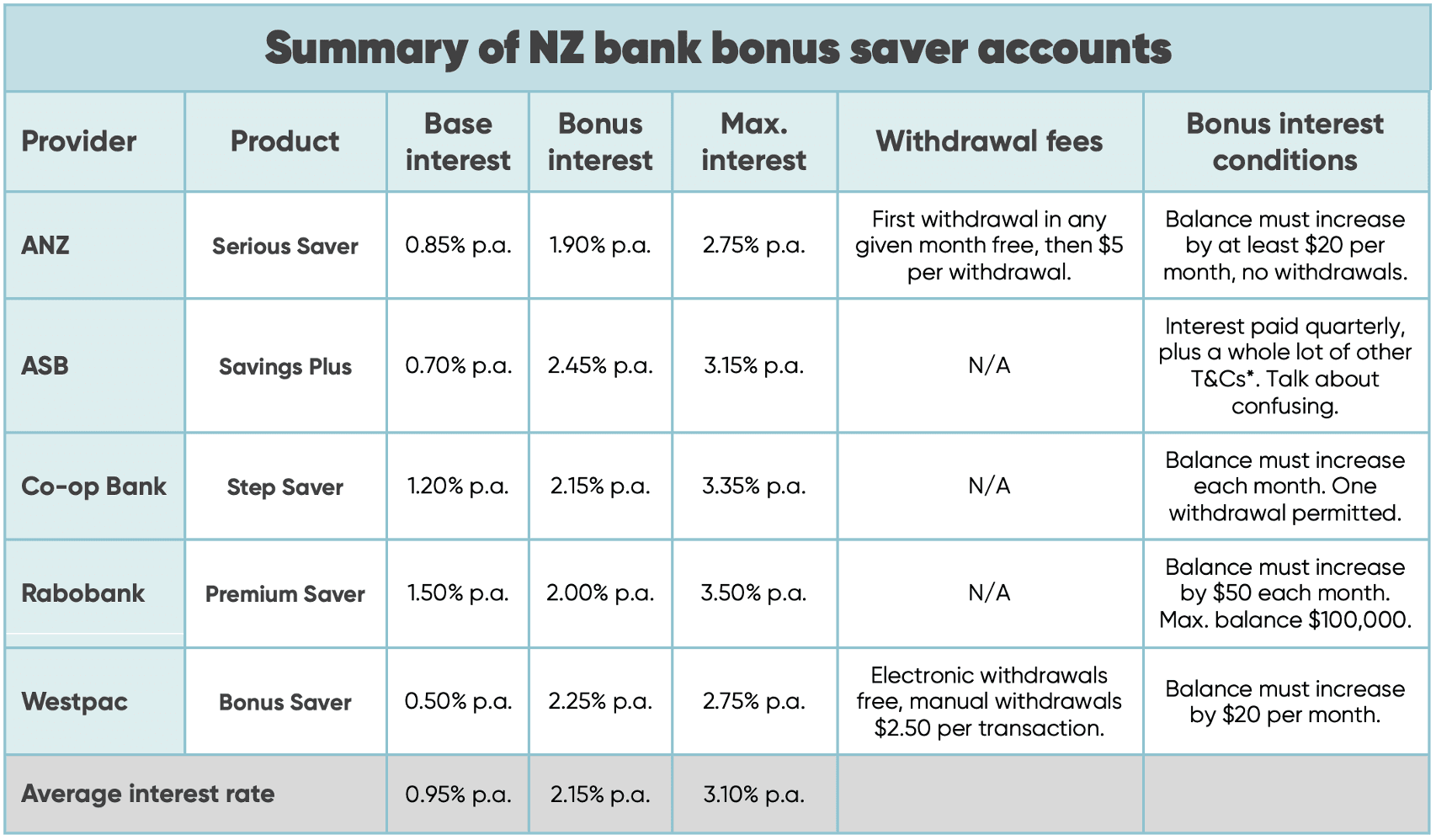

The table below summarises the different bonus saver products currently on offer across New Zealand’s retail banks:

NB: SBS Bank recently grandfathered its bonus saver product (Incentive Saver) and is milking it, hard. The max interest rate is 1.70%—and that’s with bonus interest! If you have savings in one of these, move it now!

Now, you might be thinking “those rates seem alright to me…what am I missing here?”

To answer that, let’s see how New Zealand bonus saver accounts stack up against an equivalent product from across the ditch.

Commonwealth Bank—a.k.a. CommBank, ASB’s parent company and Australia’s largest lender—currently offers the following rates on its Goal Saver account

- Base rate: 0.35%

- Bonus rate: 4.30%

- Max potential rate: 4.65%

There are two major differences between CommBank’s bonus saver rates, and those on offer in New Zealand.

The first you may have spotted already. It’s to do with the base rate.

While many New Zealand banks still offer an okay rate of return, even if you don’t meet the bonus conditions, Commonwealth Bank’s base rate is set at next to nothing. That makes its bonus rate, which is already pretty good, far more attractive by comparison.

If the whole point is to incentivise good savings habits, having a much lower base rate is a good starting point.

The second—which won’t have been immediately obvious from the info given above—is that CommBank’s maximum interest rate is actually higher than the minimum returns it could earn on these funds, set at the OCR.

Using the OCR as the benchmark to compare across countries, you’ll note that CommBank’s maximum rate is 4.65% vs. the Australian OCR at 4.10%. New Zealand banks, meanwhile, all set their maximum bonus saver rate comfortably under our OCR—currently 3.75%.

I’ll come back to why this matters shortly.

NB: All rates outlined above are accurate as at 31/03/2025.

Combined, those differences mean New Zealand banks are making much bigger margins on bonus saver product than their Australian counterparts

And the reason for that comes down to a little something called the weighted interest rate.

The banks know that, in any given interest period, only a certain proportion of bank customers are going to meet their bonus rate conditions and earn maximum potential returns.

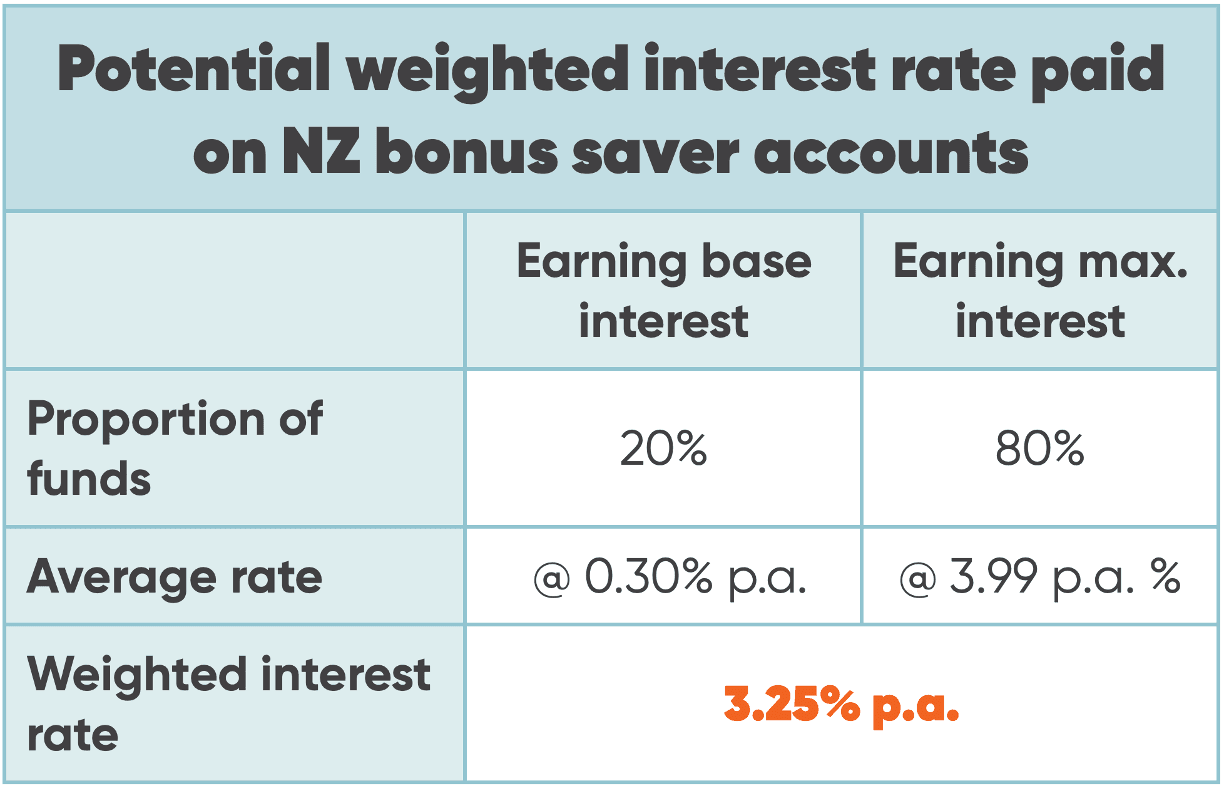

A few years ago, back in my banking days, that number was typically around 60%. But for the purposes of this article, let’s be generous and assume that it’s more like 80%—with the rest earning base interest.

That ratio means that the true cost to the banks (i.e. the weighted interest rate they’re paying on bonus saver funds) works out to be much lower than the maximum rate.

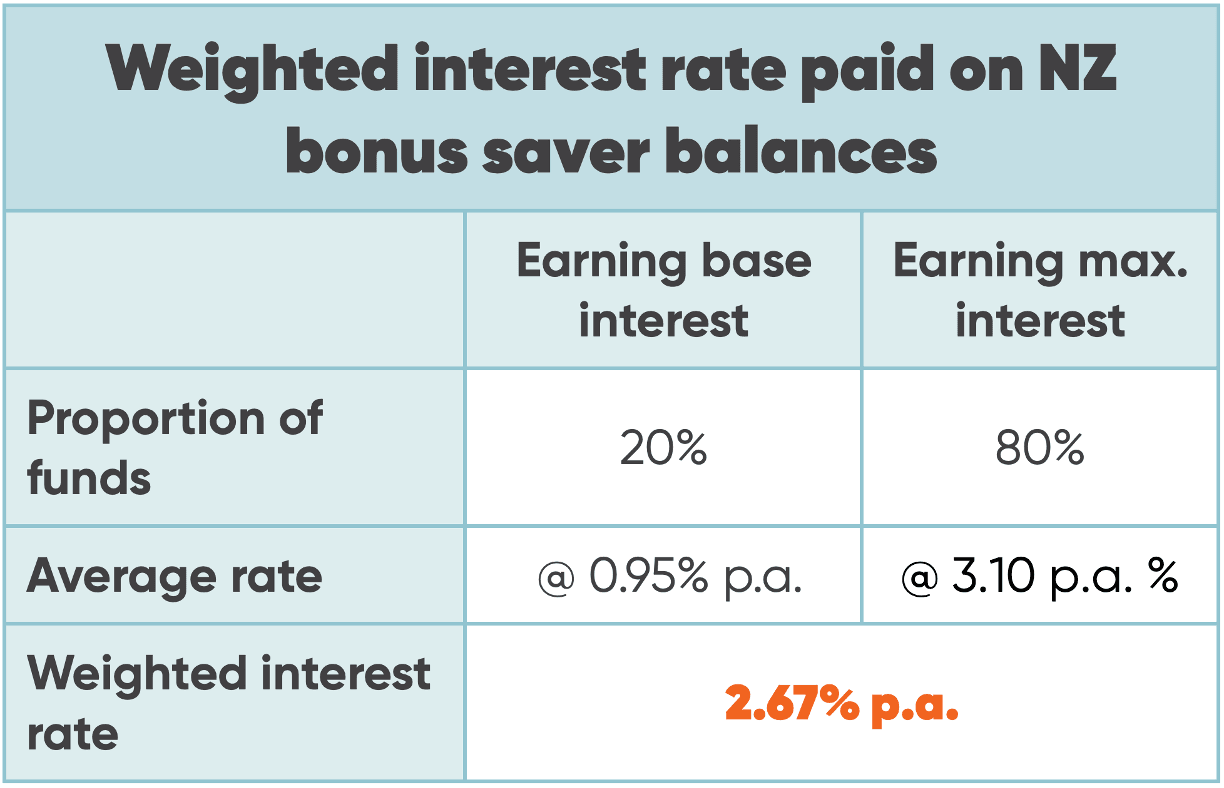

Based on the averages from Table 1, the weighted average interest rate New Zealand banks are paying on bonus saver products today works out to the below:

So, on average, our banks are paying Kiwi customers just 2.67% interest across their bonus saver account balances

Bear in mind that:

- Rabobank skews the average interest rate upwards but likely represents a smaller proportion of bonus saver balances overall. So, if we were to look at which bank holds what proportion of funds, the weighted interest rate would be even lower.

- I was very generous with the estimate around the dollars that earn the bonus interest at 80%. It’s highly likely to be lower.

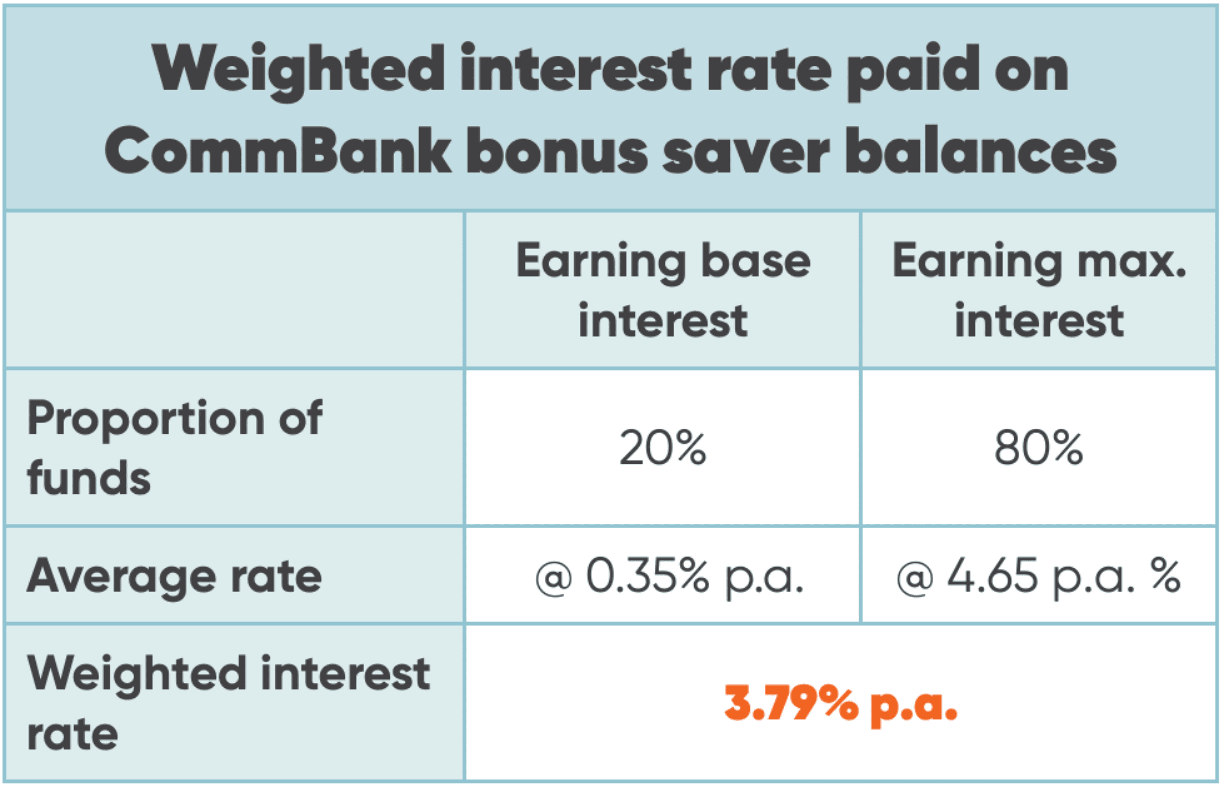

If you run the same numbers for CommBank, the weighted average interest rate works out as follows:

Now, let's look at what that means for bank profit margins...

For this next part, the important thing to know is that banks earn interest on the customer deposits (i.e. savings) they hold. How much exactly depends on what they’re doing with that money:

- The majority of funds are lent out to borrowers as mortgages, business loans, and credit cards, etc. The gross interest rate the banks earn on these funds varies by loan type, currently starting from around 5% for home loans up to about 21% on credit cards.

- What’s left is held with the Reserve Bank, where it earns an interest rate set at the Official Cash Rate (or OCR, currently 3.75%).

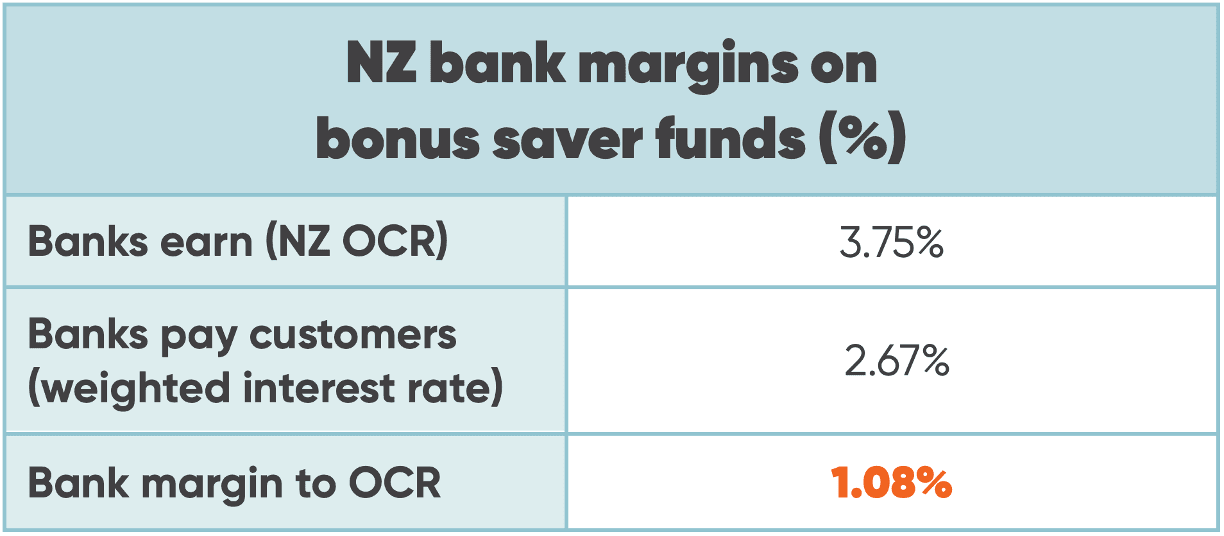

If New Zealand banks were only earning the minimum return—which certainly isn't the case (the reality will be much higher)—here’s the margin they'd be making on customers’ bonus saver funds, relative to the OCR:

So, best-case scenario, our banks are (on average) paying their customers roughly 70% of the interest they earn, keeping almost 30% for themselves.

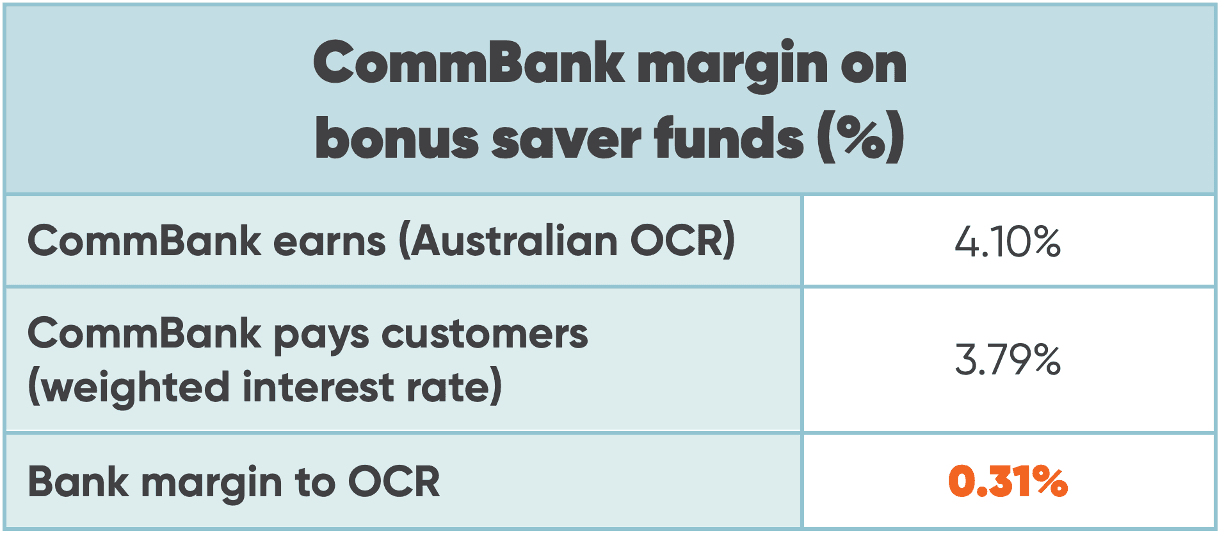

Compare that with Commonwealth Bank’s margins, relative to the Australian OCR:

That means CommBank is taking less than 8% of the interest, compared with NZ banks’ 30%.

(Side note: this is why CommBank is happy offering a bonus rate that’s higher than the minimum it earns on bonus saver funds—because it’s still making a reasonable margin, relative to the OCR, on the weighted interest rate.)

So, why are New Zealand bank margins on bonus saver accounts so much higher?

Aside from the sky-high profits to be made, this model helps to keep their funding costs of their lending down, which (in turn) makes it harder for wholesale-funded lenders, like non-banks, to compete.

Essentially, New Zealand banks are gaming their customers at a portfolio level to ensure that the economics of bonus saver accounts work largely in their favour and help to stifle lending competition.

Maybe a better question here would be 'Why are New Zealand bank margins on bonus saver accounts *allowed* to be so much higher?

Well, it appears there is some competition in the savings market (courtesy of BNZ and new players like Squirrel), so at this stage, the reason is that not enough people are making the most of what’s on offer and shifting their money.

I can almost guarantee if a flood of money exited ANZ, ASB, and Westpac from these products to better interest rate paying players we’d see a shake-up.

Do bonus saver accounts still have a place in New Zealand's savings landscape?

I’d argue yes, but only with some major changes to the way their interest rates are structured.

It used to be that every bank had a bonus saver product on offer, but that’s all changed in recent years. These days, a number of providers—including BNZ and Kiwibank—have ditched their bonus saver products altogether, going back to basics with a simple savings account that offers solid returns and no tricky rules to navigate.

- BNZ currently pays 3.20% p.a. on its standard savings product (taking a margin of 0.55% to OCR), while Kiwibank offers returns of 2.75% (margin of 1.00% to OCR).

- New fintech players—like Squirrel—have also entered the simple savings space in recent years. Squirrel’s On-Call Account currently pays 3.50% p.a. on all balances, with no strings attached (margin of 0.25% to OCR).

With so many simple savings options out there offering better returns, most bonus saver customers—particularly those with ANZ, ASB and Westpac—would be better off shifting their money elsewhere.

If (and it’s a big if) ANZ, ASB, and Westpac wanted to use their bonus products to best effect, they should be dramatically increasing the headline rate, lowering the base interest and overall doing a better job of delivering a behaviour-based product to market.

It’s worth noting that, since our latest OCR cut, a number of the banks have started to make changes taking their bonus saver account in the right direction, but there’s still plenty of work to be done.

In an ideal scenario, the rate structure on these products would look something like:

- Base interest 0.30%

- Bonus interest 3.69%

- Total interest 3.99%

Leaving the banks with a margin of 0.50% relative to the OCR—roughly the same as BNZ.

I think the numbers speak for themselves. ANZ, ASB, and Westpac are doing a pretty poor job for their savers compared with others in the market. The competition is here folks, get to it!