On 9 October, the Reserve Bank of New Zealand (RBNZ) cut the Official Cash Rate (OCR) by 0.50%.

Immediately following the announcement, New Zealand’s major banks all cut their floating home loan rates by the same amount, news of which became the big media headline.

But in New Zealand, almost all homeowners are on fixed mortgage rates, and those have barely changed at all.

Short-term fixed rates are sitting significantly above where they should be right now

Following this week’s large OCR cut, and with further big OCR cuts in the pipeline, wholesale interest rates (the rates banks fund at) are on a steep downward trajectory.

Meanwhile, advertised fixed home loan rates have remained stubbornly high, with one-year rates currently sitting at 6.29% and six-month rates at 6.70%.

As the gap between wholesale and fixed mortgage rates widens, bank profits grow.

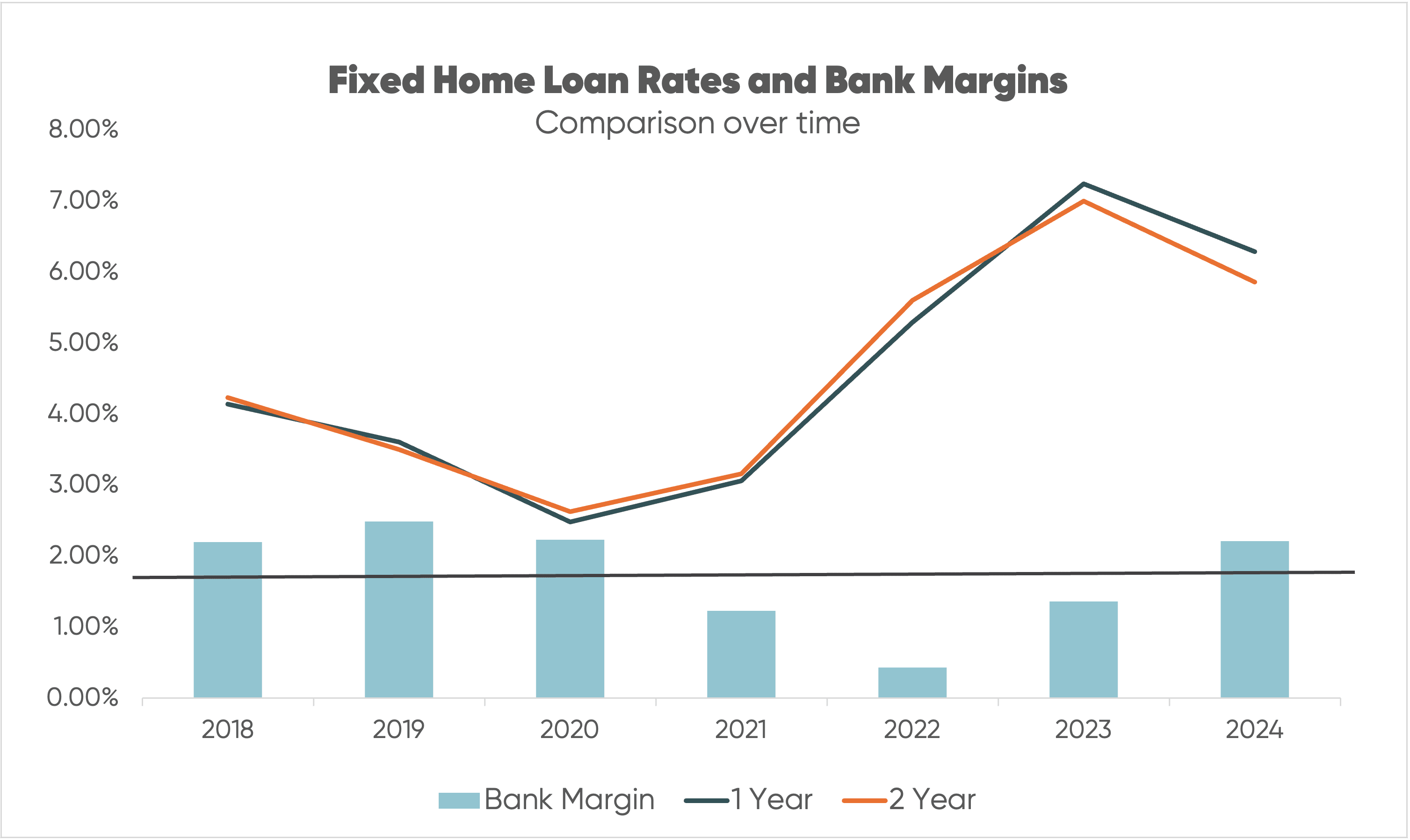

Traditionally, bank margins have always sat around 1.80%, giving homeowners room to negotiate better rates. We haven’t seen bank margins this high for a few years—as you can see from the chart below.

Margins are sitting at historic highs.

The fact is, banks will be slow to compete when rates fall.

With a weak economy, profit-maximising behaviour will cause banks to prefer margin over competing for market share.

An extra 0.50% margin equals $1.5 billion of industry profits versus a slice of anaemic growth. To be fair, that’s not the full picture, as some of the profits will be whittled away by banks paying over the odds to term deposit customers.

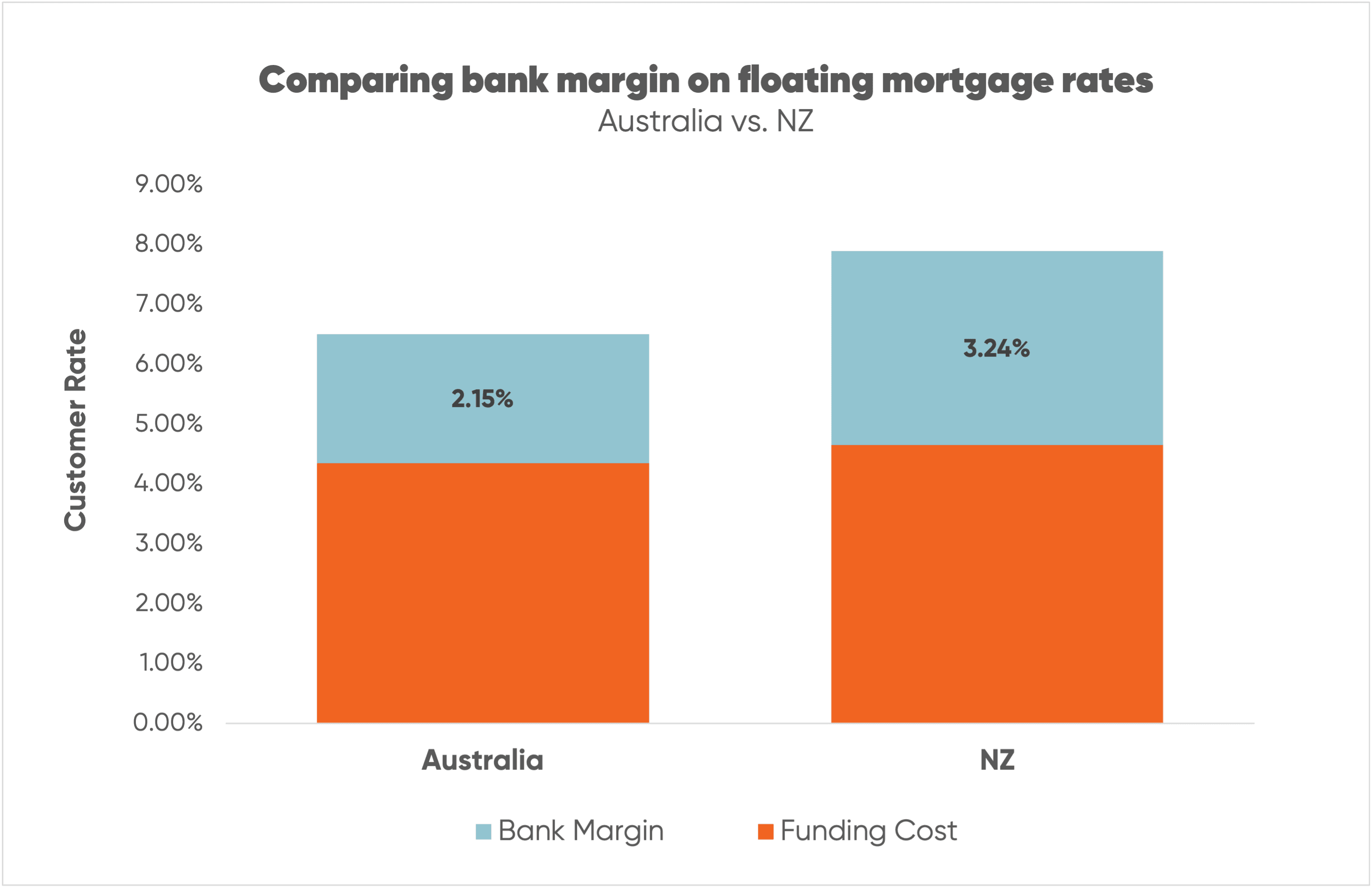

As an aside, New Zealand has abnormally high floating home loan rates at the moment, too

Look at the difference in floating home loan rate margins between the big banks in New Zealand and Australia. NZ floating rate margins are 50% higher.

The reason for this is that homeowners tend to move onto floating rates, at least temporarily, when rates are expected to fall—to give them the freedom to lock in at a lower rate, sooner.

By prioritising profits over competition on floating rates, the banks benefit from this trend in customer behaviour.

So, what sort of short-term rates should customers be getting right now?

When competition heats up, and margins pull back to 1.80%, advertised one-year fixed home loan rates should fall from around 6.29%—where they are today—to around 5.79%.

Banks are willing to negotiate on one-year fixed rates, but I believe this shouldn’t happen “under the table.” It should be advertised rates and available to everyone.

Now, more than ever, talk to a mortgage adviser to ensure you get the best deal, including rates and cash backs. It will be worthwhile.

With wholesale rates dropping sharply, this should also drop longer-term fixed home loan rates

With the Reserve Bank expected to drop the OCR back to neutral aggressively, this should also begin to be reflected in long-term fixed home loans.

If one of our banks takes the initiative, we could see a three-year fixed mortgage of 4.95% before Christmas—hopefully not just below the counter. In my mind, a mortgage rate with a 4 in front feels like a great deal*.

But it all depends on one of our banks being bold enough to go there first.

So, the challenge to the banks is this…

After a tough couple of years for homeowners and businesses, it’s time for banks to get competitive on fixed-term home loan rates above the counter and pass on the full benefit of OCR cuts to your mortgage customers.

Don’t be a Grinch and force customers to fight for a fair rate.

*Borrowers need to be realistic about what a “good” rate looks like in the current market. It’s highly unlikely (unless something big, scary, and unpredictable happens) that we’re going to see the low rates we got during COVID again any time soon. The RBNZ has said that a “neutral” OCR—which neither stimulates nor suppresses the economy—is around 3%, meaning mortgage rates should settle between 4.50% and 5.00%.