It wasn’t all that long ago that interest rate specials were the big incentive the banks used to try and win new customers.

These days, though, it’s all about cash backs.

For the uninitiated, a cash back (a.k.a. cash contribution) is pretty much exactly what it sounds like—a lump-sum payment you get for taking out a new home loan with a bank, either when you first buy a property or when you switch lenders.

Now, the promise of several thousand dollars back in your pocket might be pretty tempting stuff (who doesn’t love free money?!) but don’t let yourself be blinded by the dollar signs.

There are a few important things to be aware of, and to consider, when it comes to mortgage cash backs. Here’s what you need to know.

How much money are we talking?

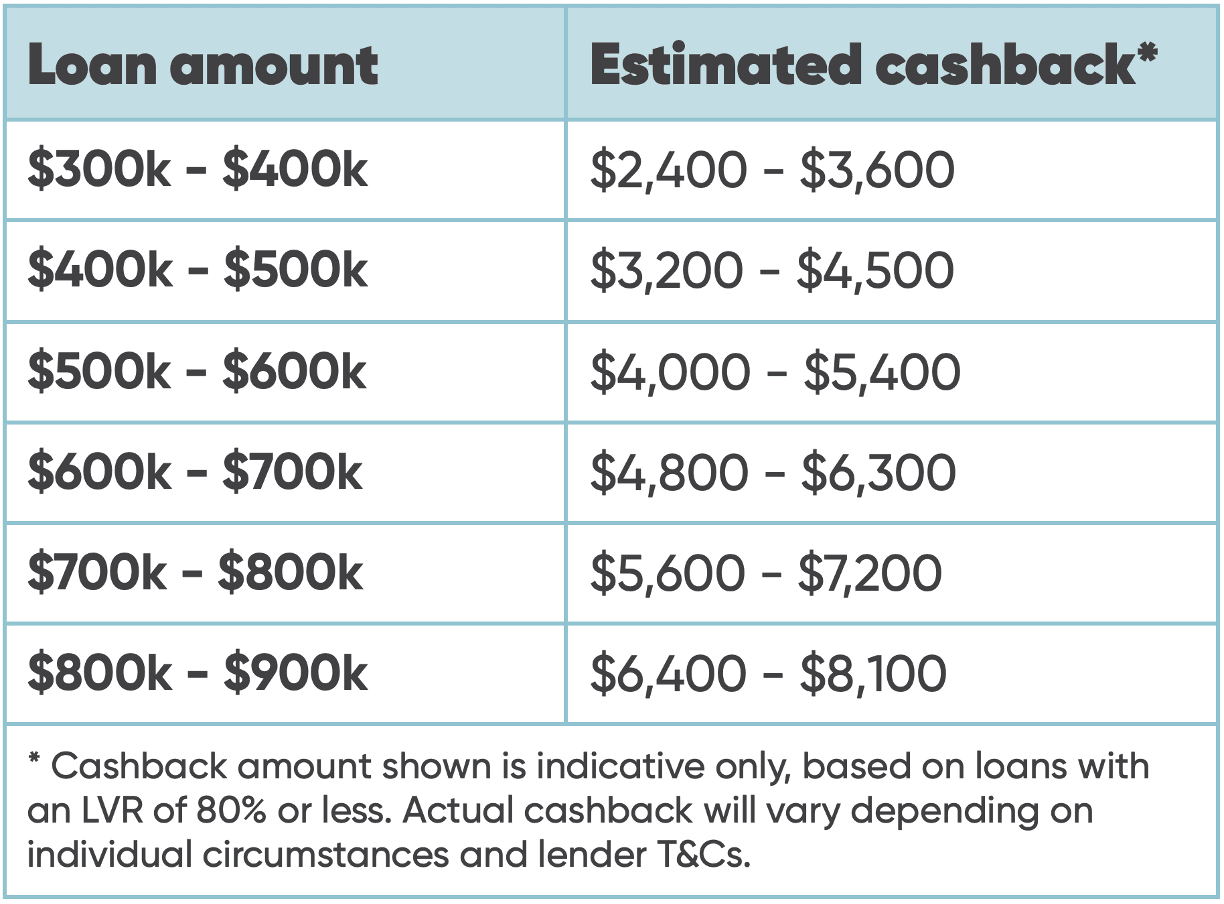

The way cash backs are calculated is based on a percentage of your overall loan value.

In recent years, the magic number has ranged from about 0.60% at the lower end of the spectrum, up to about 1.00%, depending on the bank and the state of the market (i.e. how hard lenders are having to work to attract new loans).

Right now, the standard cash contribution on offer is between 0.80% and 0.90%.

The following table gives you an idea of what that translates to, in dollar terms, for different loan sizes (assuming an LVR of 80% or above).

It's worth noting that some banks may be willing to offer you more (or less) depending on your personal situation.

If you’ve got more than the required deposit, for example, lenders are often willing to be a little more generous, while the opposite will be true for low-deposit borrowers. Whether you’re buying the property to live in, or as an investor, can also make a difference.

Some leneders are currently offering special deals to help entice first home buyers, which generally takes the form of a minimum cash back amount (regardless of loan size).

Because bank policy in this space is constantly changing, it’s always worth chatting with a mortgage adviser to help you understand where things are at,

What criteria do I need to meet in order to be eligible?

1. You need to be taking out a new loan

This is the big one.

As a general rule, to be eligible for a cash back, you’ll either need to be purchasing a new property or refinancing your existing mortgage from another lender. In other words, you won’t qualify for simply refixing your loan with your current bank (sorry!).

Banks may be open to negotiating a cash back on loan top-ups as well, depending on the lender in question and your situation.

2. You generally need to be borrowing over a certain amount

The official word from the banks is that you need to be borrowing at least $250,000 to qualify—although a good mortgage adviser may be able to negotiate a cash back on your behalf, even if you’re below that threshold.

Can my cash contribution be clawed back by my lender?

Yes it can, up to a point.

All mortgage cash backs are subject to a clawback period, where—if you refinance or repay your loan within that timeframe (including if you decide to sell your house)—lenders have the right to reclaim all, or some, of the cash back amount.

Up until relatively recently, the banks all structured their clawback frameworks slightly differently, with different clawback amounts at different milestones, and clawback periods spanning either three or four years.

It made the job of comparing offers pretty confusing work for borrowers.

As part of its report into competition in banking, released in 2024, the Commerce Commission labelled the practice “anti-competitive”, particularly given the way clawbacks were structured to deter borrowers from refinancing at the one- and two-year mark.

As a result, the Commerce Commission’s recommendation, the framework has now been standardised, meaning all lenders now work on a pro-rata basis (although still with a mix of three and four year terms across different banks).

Now, if you refinance or repay your loan the amount drops in line with the remaining term of the clawback.

Can I use my cash back to help pay my mortgage off faster?

In theory, you can use your cash back for whatever you like. Renovations, new furniture, a much-needed holiday—the list goes on and on.

But if you want to be really smart about it, you might want to consider squirrelling that money away, and using it to pay a lump sum off your mortgage when your fixed term loan comes up for maturity.

By taking advantage of cash back opportunities as often as you can (i.e. by refinancing every three or four years) and using that money to pay a lump-sum off your mortgage every time, you’ll end up knocking roughly two years off your loan term.

We’ve pulled together a whole bunch of other tips to help you pay your mortgage off faster in our handy refixing and refinancing guide, which you can download here.

Why chatting to a mortgage broker is always a good idea

Of course cash backs and interest rates are important, but they're not the only thing you need to be thinking about when taking out a new loan with a lender.

And that's where a good mortgage broker comes in.

We'll work with you to find the right mortgage structure for your situation—and can offer recommendations to help you get your loan paid off faster, and potentially save thousands on interest.

You don't get that sort of personalised advice when you go direct to the bank.

Get in touch today if you’d like to chat with one of our friendly mortgage advisers for guidance on cash backs, and help negotiating the best possible deal.

Book a chat with a mortgage adviser

About the author: John Bolton (JB), Squirrel Founder & Group Head of Property Finance