To state the obvious, it’s been a hostile couple of years for residential construction.

With inflated build costs and land prices driving up the price of new homes and high interest rates slashing buyers’ borrower power, many have found themselves unable to afford to build or buy new—and construction activity stalled.

But now, particularly with interest rates on the way down again, some of those factors have started to unwind, meaning there’s finally some light at the end of the tunnel.

Falling interest rates will improve borrower affordability

Experts predict another 0.50% cut in November, bringing the Official Cash Rate down to 4.25%. Following that—and assuming inflation continues to track as hoped—we’ll likely see a series of smaller reductions over the first half of 2025, getting us back to a ‘neutral’ OCR of around 3% towards mid-next year.

Notably, rates are unlikely to fall to the levels we saw during COVID-19. Once we return to that ‘neutral’ point, mortgage rates should settle somewhere between 4.5% and 5%.

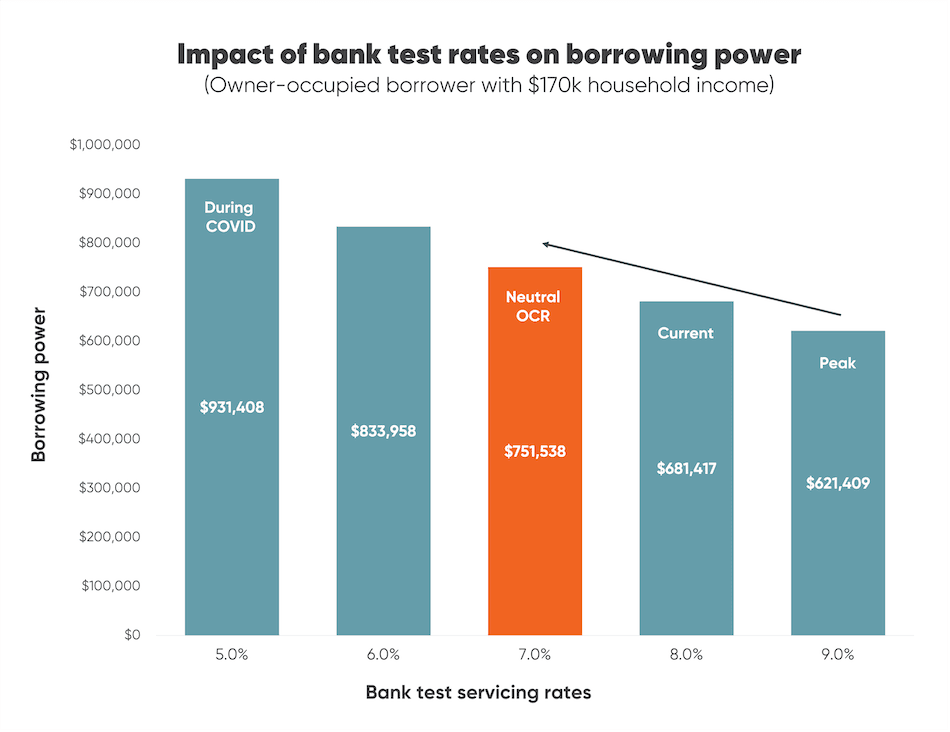

Banks assess borrower affordability using ‘test’ rates, which are about 2% higher than the best mortgage rate on offer in the market (typically the two-year fixed term).

Test rates climbed to almost 9% at their latest peak, meaning buyers with an annual household income of $170,000—who could afford mortgage payments of $5,000 per month—were able to borrow just $621,000.

In the wake of recent OCR cuts, test rates have already fallen to 8% and should drop further to 7% once mortgage rates bottom out.

That would allow that same buyer to borrow up to $751,000—an increase of about 21%. It’s not huge, and (again) buyer affordability won’t get back to where it was during the pandemic, but it’s improving.

That should help to bring build prices back within reach for those who were almost there

The impact will vary across the country—and will be more muted in regions where there is a lack of affordability. But it should create more demand, particularly for single-house builds.

As far as development projects are concerned, falling house prices over the last couple of years have helped make development land more affordable. Part of what drove the housing boom was the sheer number of small-scale townhouse developers pushing up land prices. That heat has gone from the market and many inexperienced developers will have lost confidence and capital.

While high construction costs will likely present some ongoing challenges, the foundations are there for a slow and steady recovery for residential construction over the next few years.

Just don’t expect the next boom anytime soon.

Got a project in mind? Check out our funding solutions to get things moving.