While high interest rates are terrible news for borrowers, they can be great news for savers.

The last couple of years have seen the rate of return on savings accounts in New Zealand creep up from an average of 0.15% p.a. in August 2021, when the Official Cash Rate first started to climb, to 3.66% p.a. today (source: RBNZ).

The average rate on term deposits has skyrocketed as well—from 1.06% p.a. to 5.84% p.a. (source: RBNZ).

But with the OCR now tracking downwards at pace, chances are you’ve already noticed that starting to chip away at what the bank pays you for your savings.

In this article, we’ll explain why that is, and the options you have to keep earning great returns on your savings even in a falling interest rate environment.

Why do bank savings account rates drop when the OCR does?

In short, it’s all to do with liquidity—or, more specifically, the way the banks manage their cash reserves to make sure they can meet their short-term obligations to customers.

When you deposit money into a standard bank savings account (such as an on-call or bonus savings account) there’s nothing to stop you from taking that money out again any time you like.

So, the banks need to make sure they’ve always got a good level of cash reserves on hand so that—even if a whole bunch of customers decide to withdraw their savings at once—they have access to enough liquid funds to be able to honour all of those transactions.

Now, they can hold these cash reserves with the Reserve Bank (a.k.a. the banks’ bank) where that money earns a rate of return set at the OCR. The bulk of that return is then passed directly onto their savings customers.

When the OCR goes down, the banks earn less on these funds—and so, in turn, they pass less onto their customers.

Sometimes, though, bank savings rates move independently of the OCR

And the reason for that comes down to basic supply and demand.

The banks rely pretty heavily on customer savings—mostly longer-term savings, like term deposits, but also a small proportion of those short-term savings we just talked about—as their major source of funding.

In other words, retail deposits (as they’re otherwise known) make up the bulk of the money the banks lend out to borrowers in the form of things like home loans, business loans and credit cards.

So, as you can imagine, when something big happens to disrupt the supply of customers savings, that can cause real issues.

During the Global Financial Crisis, for example, some people and institutions lost confidence in the financial markets, choosing to withdraw their savings from the bank, holding them as cash instead or moving their money to perceived safe havens.

As a result, customer deposits became more valuable to banks and they ramped up the rate of return on their savings accounts to try and attract customer deposits—allowing them to continue to meet borrower demand without having to resort to more expensive sources of funding (more on that shortly).

The opposite is also true. When borrower demand drops off, customer savings become less valuable, so the banks may choose to lower returns on their savings accounts.

Finally, the banks are always setting their savings (and mortgage) rates with a very close eye on their net interest margin

The main way that our banks make money in New Zealand is via what’s known as their net interest margin.

In really simple terms, the net interest margin is calculated as the difference between the banks’ overall funding costs (i.e. the interest rate they pay on deposits, bonds they’ve issued, and other money they may have borrowed), and the overall interest rate they charge borrowers across all their different loan types (such as overdrafts, home loans, and business loans).

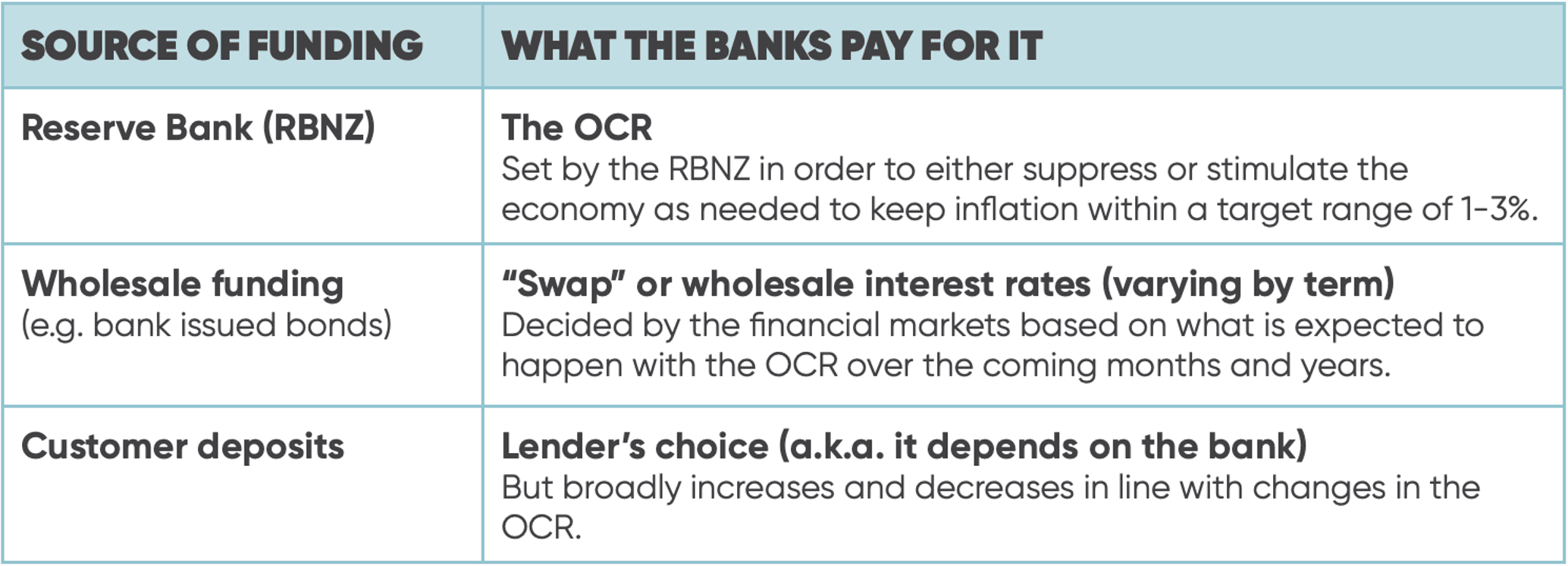

In New Zealand, our banks have three main sources of deposits—each of which has a different cost, or interest rate, associated with it:

As you’d expect, the banks keep an extremely close eye on their net interest margin.

As the cost of RBNZ and wholesale funding changes (thanks to movements in the OCR), the banks adjust their savings and mortgage rates accordingly, to ensure that—across the big picture—that margin is maintained.

Over the last few years, the average net interest margin earned by New Zealand banks has sat somewhere between 2.17% and 2.38% (source: RBNZ)

Why has the interest rate on the Squirrel On-Call account dropped with the OCR?

At Squirrel, the way things work with our On-Call account is a little different.

Funds in the Squirrel On-Call account are held on trust with leading New Zealand retail banks—the banks pays us interest on those funds, and we pass the lion’s share of that directly onto our customers.

Now that the OCR is on the way down again, the rate of return we earn on these funds has dropped, and so we’ve had to drop our On-Call account interest rate as well.

Now that interest rates are on the way down again, what can I do to make sure I'm earning the best possible return on my savings?

1) Don’t assume that the deposit rates you get with your bank are the best you’re going to get.

Because lenders have the discretion to set their deposit interest rates pretty much however they like, that means not all savings accounts are created equal.

We’ve done a comparison of the best and worst bank savings accounts on offer in New Zealand, to help take some of the work out of the equation for you.

2) Consider putting your money into Squirrel Term Investments, or the Squirrel Monthly Income Fund instead

Squirrel Term Investments

When you invest in a Squirrel term investment class, your money is helping to fund the unique loan solutions we’ve designed to meet the need of credit-worthy homeowners (or would-be homeowners) who, for whatever reason, don’t tick traditional lending boxes.

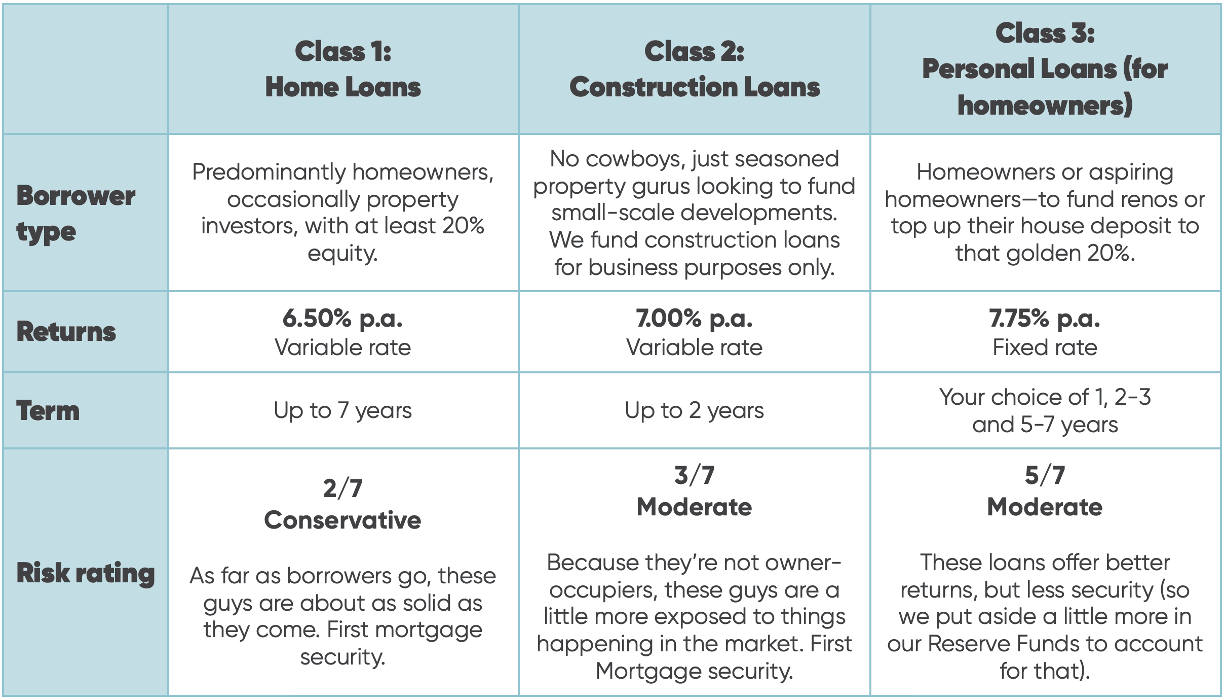

We have three classes of term investment available to invest in via our platform, each of which pays a great rate of return—currently ranging between 6.50% and 7.75%—and with different options to suit different risk appetites.

Here's the other important stuff you need to know about Squirrel term investments:

- Your money’s not locked away forever: Should you need to access liquidity, you can list your investment for sale, at no cost, on our Secondary Market, where it can be taken up by another Squirrel investor. Please note, we can’t guarantee another investor will be willing to buy, and you may need to hold your investment to term.

- You’ll have the protection of our Reserve Funds: In the event a borrower misses a repayment or defaults on their loan, our associated Reserve Fund will step in to cover the payment. To date, no investor has ever lost a cent – although past performance doesn’t guarantee future performance. We have lots of information about our Reserve Funds available on our website.

- Returns are paid directly into your Squirrel On-Call account.

- And you can view and manage your investments 24/7 via the Squirrel platform: meaning you can check on, make or sell an investment any time you like.

For more information, read up on our term investments page here—or if you’re keen to get started, it takes just five minutes to register with us.

The Squirrel Monthly Income Fund (SMIF)

When you invest in the Squirrel Monthly Income Fund, your money’s still helping to fund loans for Kiwi homeowners, it’s just a more hands-off way to go about it.

Rather that investing directly into a specific term investment type (or types), you’re investing in a diversified portfolio of loans, that includes both our Home Loan and Construction Loan term investments.

This means you earn a single great rate of return, paid monthly—which you can either choose to reinvest or have paid out into your Squirrel On-Call account. PIE tax is managed for you as part of the process.

The specific makeup of the fund at any given time is decided by our fund manager, FundRock, together with our team here at Squirrel—but it’s at the more conservative end of the spectrum.

Other things you need to know about the SMIF:

- You can choose how you want to invest: the SMIF is available to invest in both via the Squirrel platform, and via InvestNow. Investing direct via our platform means you get the Squirrel experience the whole way through—but if you’re already an InvestNow customer, you can just choose to add the SMIF to your existing mix of investments.

- You’re still investing in loans that have Squirrel Reserve Fund protection: meaning if a borrower misses a payment, or defaults on their loan, our associated Reserve Fund will step in to cover the payment. To date, no investor has ever lost a cent – although past performance doesn’t guarantee future performance.

- You can get your money out in 30 days: if you need to access liquidity, you can withdraw some or all of your money with 30 days’ notice. We’ll always aim to get your money back to you sooner if we can, although we can’t guarantee that will be possible.

For more information about the Squirrel Monthly Income Fund, check out our website—or register for a Squirrel On-Call account here in under five minutes.