In a nutshell:

- People are often put off the idea of refinancing—a.k.a. switching lenders—by the thought of all the life admin involved.

- But refinancing has a whole raft of benefits that can make it well worth the time and effort. With banks currently offering thousands in cashbacks on new loans, plus the chance to restructure your mortgage lending and other debts to get them working better for you, the pay-off can be significant.

- If you’re not sure whether refinancing is right for you, get in touch for a chat with a Squirrel mortgage adviser who can talk you through your options.

Us Kiwi like to keep things nice and simple when managing our home loans (as much as that’s a thing) so it’s little wonder that home loan refinance has traditionally been a less popular option for New Zealand borrowers.

The process takes time, and it (usually) involves paying a lawyer—so, if you’re not exactly sure how you stand to benefit, switching lenders can seem like a lot of faffing around for little return.

But that’s just what the banks want you think.

If you like the idea of a few thousand dollars back in the bank and having the opportunity to restructure your mortgage and overall financial situation to get it working better for you, home loan refinancing could be well worth the effort.

So, what are the major benefits to refinancing? What are the eligibility criteria? And what does the process involve?

Let’s get into it.

What are the benefits to refinancing?

Ahhh, where to start? There are lots of benefits to be had from refinancing, but the big ones are:

- Cashbacks i.e. thousands of dollars back in the bank, just for a few hours’ worth of admin.

- The chance to restructure your mortgage and other debts to get them working better for you (potentially saving thousands on interest).

- You can also potentially get access to different banking products—green loans and credit cards—that are more suited to your needs.

1. Cashbacks

This is the big one for a lot of people.

These days, lenders aren’t shy about flashing a bit of cash as a little sweetener to get new mortgage customers in the door.

And that’s precisely what cashbacks are—a lump-sum payment you get for taking out a new loan with a bank, whether you’re buying a property or switching over from your existing mortgage lender.

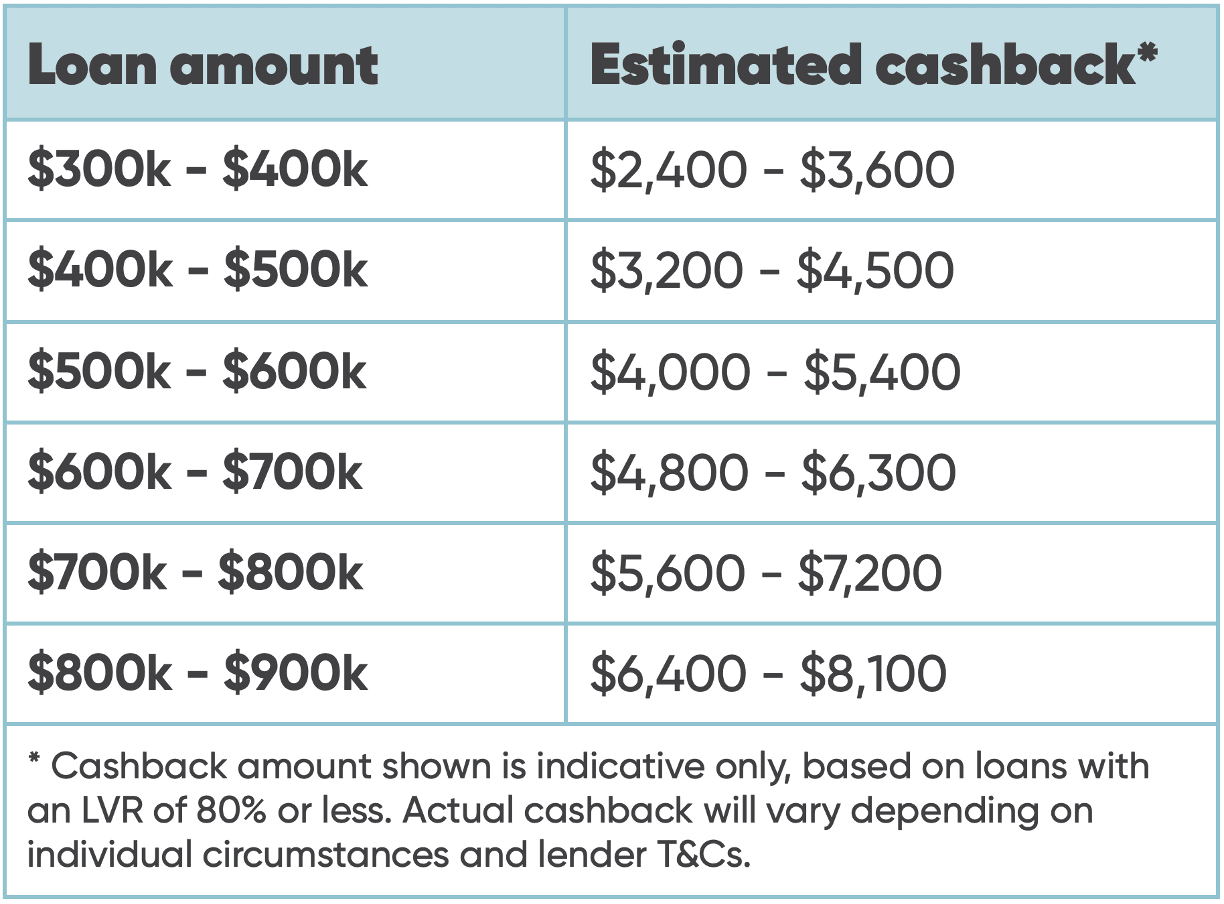

How much you stand to get is generally calculated as a percentage of your overall loan value, with the standard in recent months being somewhere between 0.80% and 0.90%.

We’ve pulled together the table below to give you an idea of what that translates to in dollar terms for different loan sizes (based on an LVR of 80% or above).

Check out this article for more information on cashbacks, how they work, and what to be aware of.

2. Reviewing your mortgage structure & other debts

Switching lenders should be an opportunity to take a step back and examine the big picture of your mortgage and other debts, assess if there’s a better way to structure things, and potentially save yourself a lot of money.

Options you have when refinancing include:

- Adjusting your loan term: either knocking a few years off if possible, saving you thousands in interest, or extending the loan term to reduce repayments (subject to bank criteria).

- Consolidating debt: clearing high-interest debt (like credit cards) and adding the balance to your mortgage.

- Optimising debt tax for property investors: potential to reshuffle debt on owner-occupied properties to rental properties, to maximise tax benefits.

3. Access to other wrap-around banking products that better suit your needs

Credit card rewards

Banks are notorious for switching up their credit card benefits every few years, which can be a real pain if you’ve chosen a product specifically for the perks.

For example, with me, it’s Airpoints. Or more specifically, Air New Zealand status points.

I travel a fair bit for work, which means having an elite membership (and all the benefits like free lounge access) matters. So much so that over the last 12 months, I’ve shifted my credit card three times—from ANZ to Kiwibank and now Westpac—chasing the best deal.

Now, I appreciate that not everyone will feel quite as passionately about this as I do, but it is something to bear in mind as part of the bigger picture when considering your refinancing options.

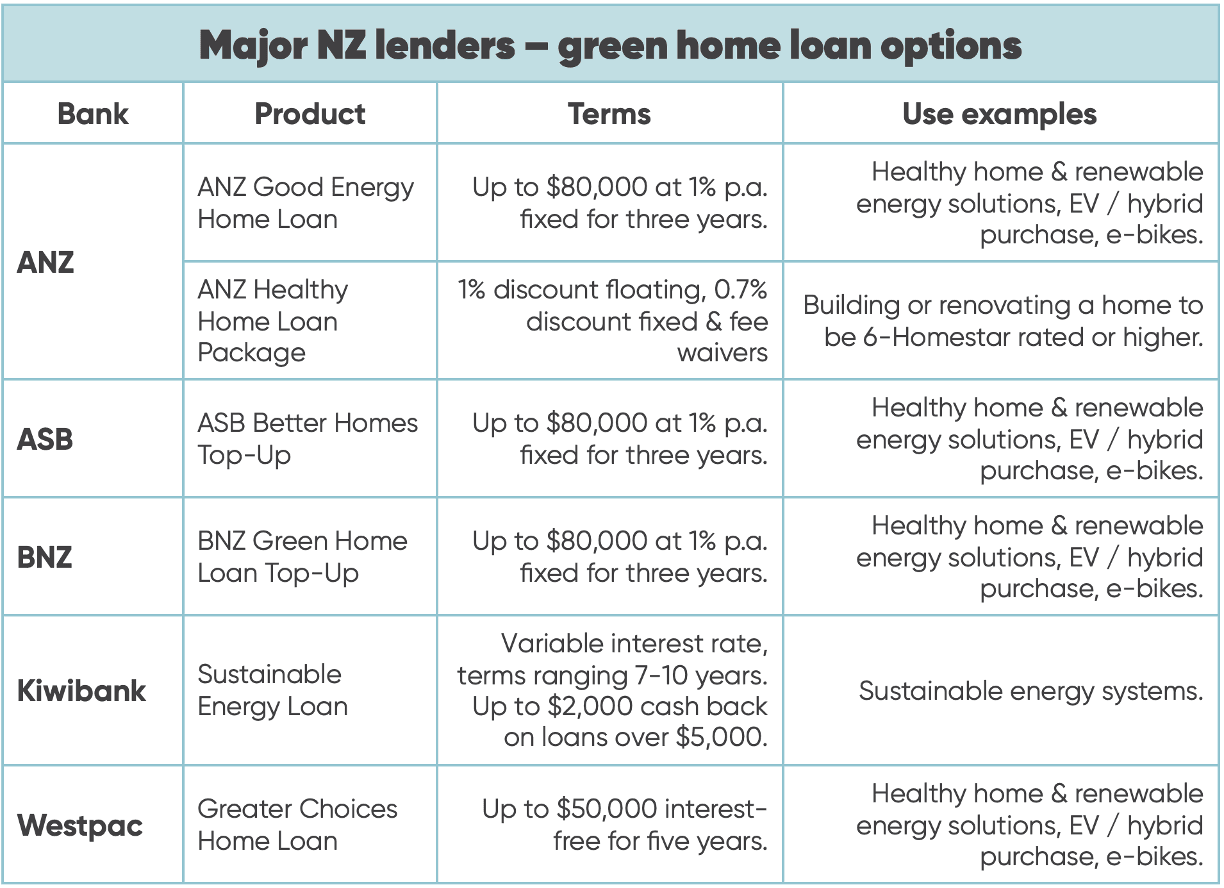

Green home loans / top-ups

These days, every major New Zealand bank offers a version of a ‘green’ home loan or top-up, essentially giving borrowers access to cheap money for upgrades to make their homes healthier and/or more energy efficient.

They’re a great product that (in my view) is sorely underutilised. Because if you’re smart about how you use them, the benefits, both financial and otherwise, are massive.

The sorts of things you can use a green loan for include:

- Installing solar panels – the up-front cost might be significant, but after a few years it’s paid for itself.

- Buying a hybrid vehicle or EV (excl. Kiwibank) – ditto.

- Window glazing and other insulation make your home warmer and drier and help you save on heating/cooling costs.

Solar power or an EV could save you $300 to $400 monthly in cash outlay, which you can use to repay debt.

The table below summarises the different green home loan products offered by the major banks and their key T&Cs.

What’s the eligibility criteria for refinancing?

Refinances are subject to all the same eligibility criteria as a standard mortgage application—which means you’ll need to demonstrate two key things:

- Your ability to service the loan, and

- That you have enough equity in your home to meet bank LVR requirements

The former shouldn’t be an issue if you’re just looking at a straight swap, without making any major changes to your mortgage structure.

You'll need to run the numbers if you’re keen to do anything like significantly shortening your loan term. Your Squirrel adviser can help you work out what’s feasible.

Considering recent house price falls—which have steadily chipped away at people’s equity—the second point may be a roadblock, particularly for those who bought at (or near) the peak of the market in late 2021 and are perhaps now in a negative equity scenario.

Beyond that, there are a couple of other questions you should be asking to help you decide whether or not now's a good time to move ahead.

1. Are you through (or nearly through) any existing cashback claw-back period?

If you received a cashback when you took out your current loan, it will be subject to a clawback period of either three or four years, depending on the lender.

Should you decide to switch banks before that time is up, you’ll have to repay some (or all) of your previous cashback amount.

With interest rates having fallen significantly in the last few months, there will be some cases where it makes financial sense to incur a partial clawback if it means being able to refinance to a lower rate.

Your Squirrel adviser can help you determine whether that’s the case for you.

How close are any fixed-term loans to maturity?

When interest rates are falling (as they are now), there is another potential cost to refinancing which borrowers need to consider.

Should you decide you want to break and repay your existing loan before term, you’ll usually be hit with break fees—and depending on how long you’ve got left on your loan, they can easily run into the tens of thousands of dollars.

Sometimes it’ll be worth taking a small hit—and again, your Squirrel adviser can help you run the numbers to work out what will leave you better off—but as a rule, refinancing once all your loans have matured is the recommended approach.

So, what does refinancing involve?

- Completing a new loan application (doing it via an adviser can streamline the process)

- Getting a lawyer in to sign off on the new loan documents

- Switching your banking over to your new lender

There’s no getting around the fact that refinancing *is* a bit of a process, but it’s probably not as time-intensive as you think.

First up, you’ll need to fill out a new loan application.

Squirrel’s online application is designed to make this step as quick and painless as possible—so the lengthiest part of the process will be getting all your supporting paperwork (pay slips, bank statements, etc.) together.

The beauty of doing it through Squirrel, too, is that you’ll only have to fill out one application, which we can then submit to multiple lenders on your behalf.

Once we have everything we need, we package it up and send it to the banks for review.

Bank turnaround times on new applications can vary pretty wildly, depending on the individual lender and how busy they are. Right now, you’ll want to factor in about 10 working days, just to be on the safe side.

When you’ve got your approval, you’ll need to get a lawyer involved to sign off on everything.

Some lenders offer a free refinancing service; otherwise, you’ll probably pay between $1,500 and $2,000.

And then it’s a matter of switching your banking.

They’re not always super strict about enforcing it, but your new mortgage lender will generally want you to have your source of income (salary or wages) directly credited into an account with them.

Most banks can organise what’s known as a ‘bank switch’ to transfer over all your direct debits, etc., which can remove a lot of the admin from the process.

So, there you have it—everything you need to know about refinancing in 2000 words or less.

And if there’s one key takeaway, it's that you shouldn't let the thought of a bit of admin put you off, when switching lenders could be just the thing you need to save thousands and get your home loan working better for you.

If you’re thinking about switching lenders but need some guidance on whether or not it’s the right move for you, book a chat with a Squirrel mortgage adviser today.

Chat to a Squirrel adviser about refinancing

About the author: John Bolton (JB), Squirrel Founder & Group Head of Property Finance