Under Adrian Orr’s leadership, the Reserve Bank (RBNZ) has become worse at making Official Cash Rate (OCR) decisions.

It’s now slower to react to economic developments and when it (belatedly) cuts or hikes the OCR it inevitably goes too far. This, in turn, has made it harder to manage businesses, made buying a house riskier, and has made it harder for people living on fixed interest income to budget.

And unfortunately, there’s no change in sight—so strap in for the next RBNZ-sponsored joy ride.

The RBNZ is tasked with keeping CPI inflation between 1% and 3%

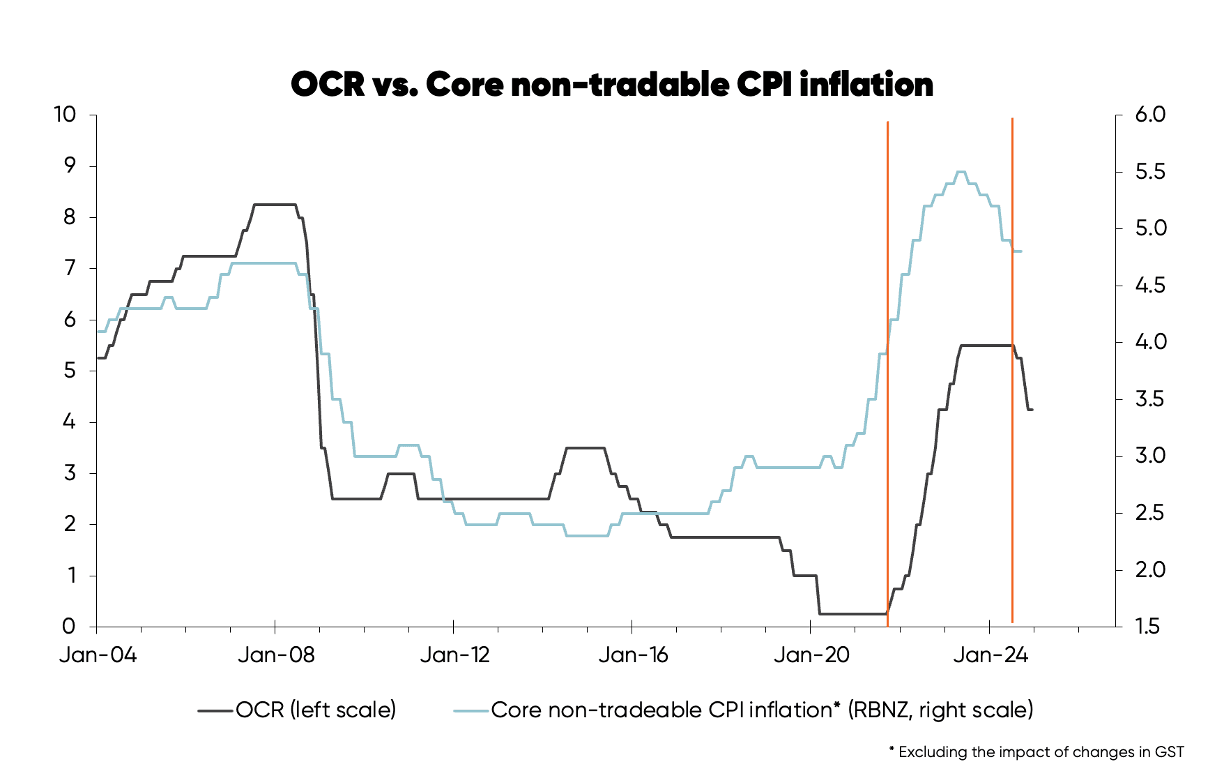

To achieve that target, the RBNZ should keep the closest eye on non-tradable or domestic inflation. The non-tradable component of CPI measures price inflation for goods and services largely produced and consumed in NZ. The blue line in the first chart, below, tracks the RBNZ’s measure of core non-tradable or domestic inflation.

As you can see, the RBNZ has delivered two series of major OCR hikes since 2004, both following increases in domestic inflation.

It takes around 2 and a half years for changes in interest rates to impact on inflation, as I’ve talked about previously.

The latest round of OCR increases didn’t start until after domestic inflation was already above 3.5% (red line). By waiting for inflation to become entrenched before starting to hike, the RBNZ ensured inflation was a much bigger problem than if it had moved earlier.

The first chart also shows that the major OCR cuts in 2008 largely coincided with the fall in domestic inflation. The latest cuts, however, didn’t start until after domestic inflation had started to fall. In other words, under Orr’s leadership (he took the reins in 2018) the RBNZ has become slower to respond to inflation.

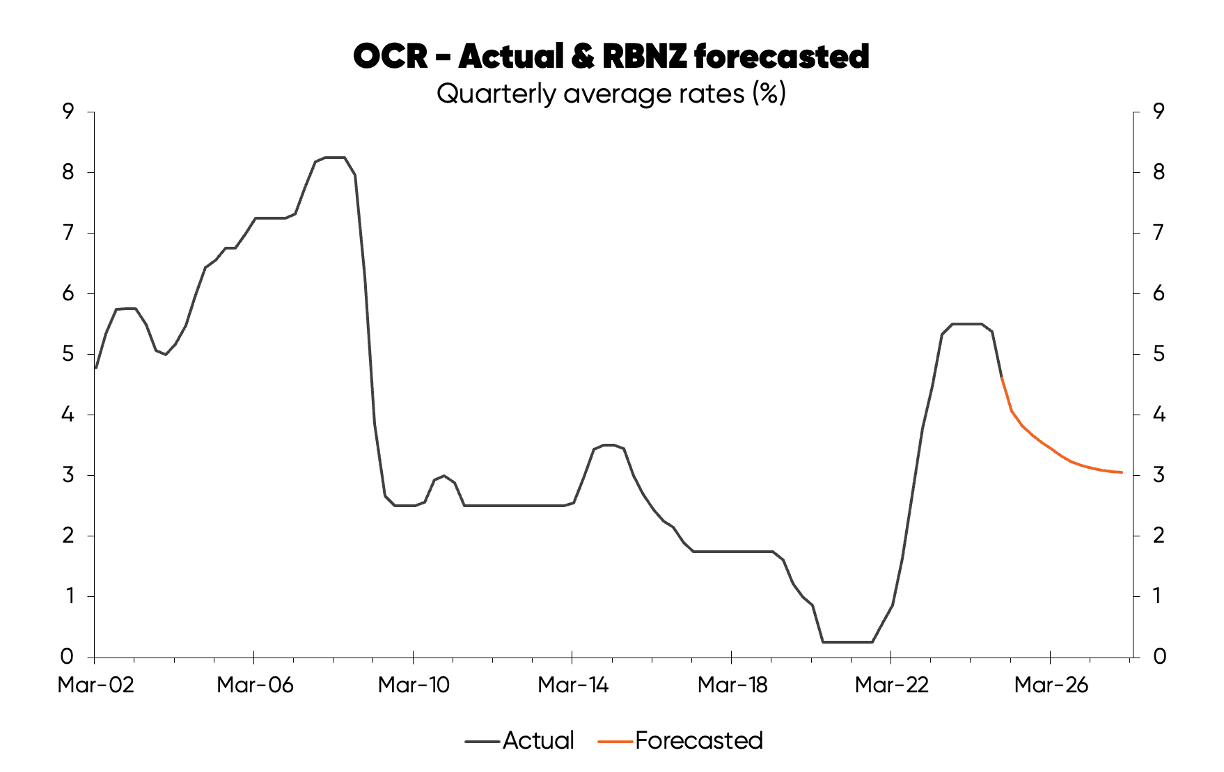

Allowing for the normal lag, it will take until late-2025 to early-2026 for the tail-end of the OCR hikes in 2023 to impact on inflation. Reflecting its reactive decision making, the RBNZ plans to keep cutting the OCR over the next two years (as shown in the second chart).

This reactionary approach will ensure it cuts too much, just as it hiked excessively at the other end.

The RBNZ’s reactive decisions cause economic and housing cycles to be more extreme than need be.

My criticism is much more than hindsight: the RBNZ could easily make better OCR decisions

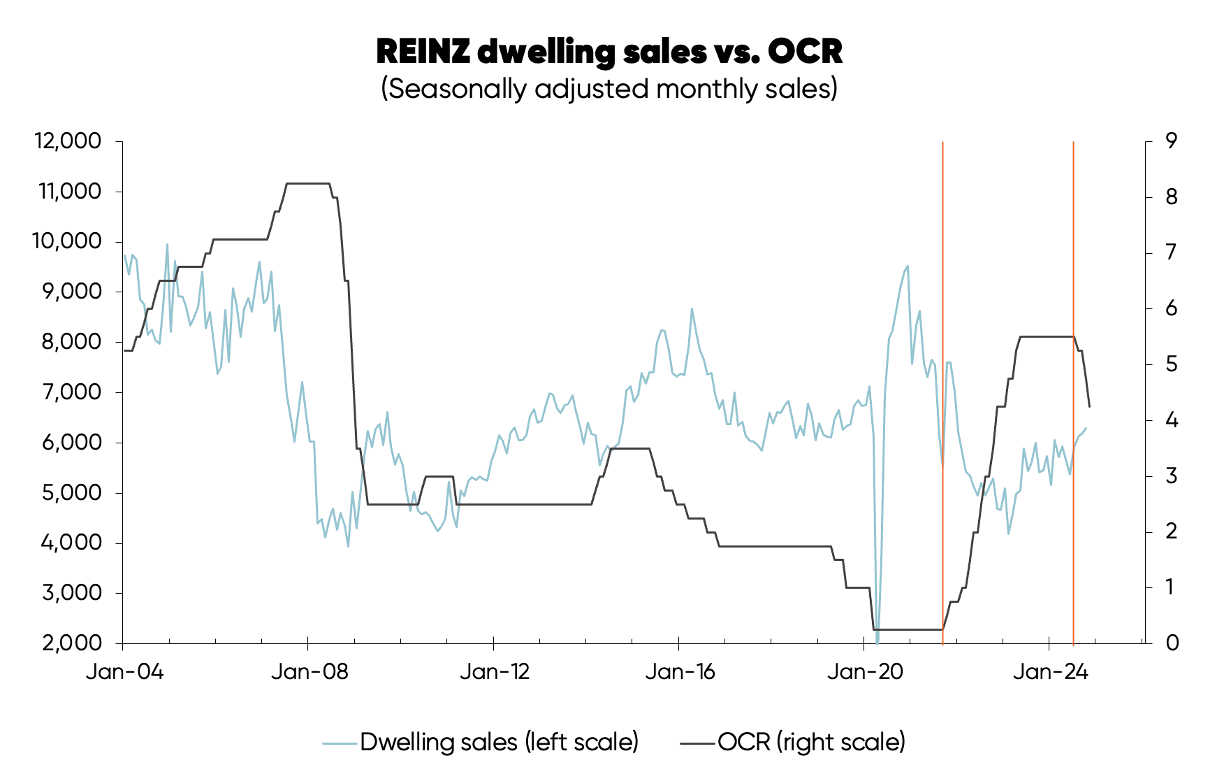

Housing, for example, plays a pivotal role in economic cycles—and there were warning signs from within the housing market months earlier which the RBNZ ignored.

The surge in dwelling sales reported by REINZ in late 2020—to the highest level in almost 20 years—should have prompted concern from the RBNZ that it had overheated the economy (third chart).

Still, from that point, it waited a year before starting to hike the OCR.

Likewise, a tumble in REINZ dwelling sales to the lowest levels in 20 years in late-2022 to early-2023 should have warned the RBNZ it had overdone the OCR hikes, but it did not start to cut the OCR for more than a year.

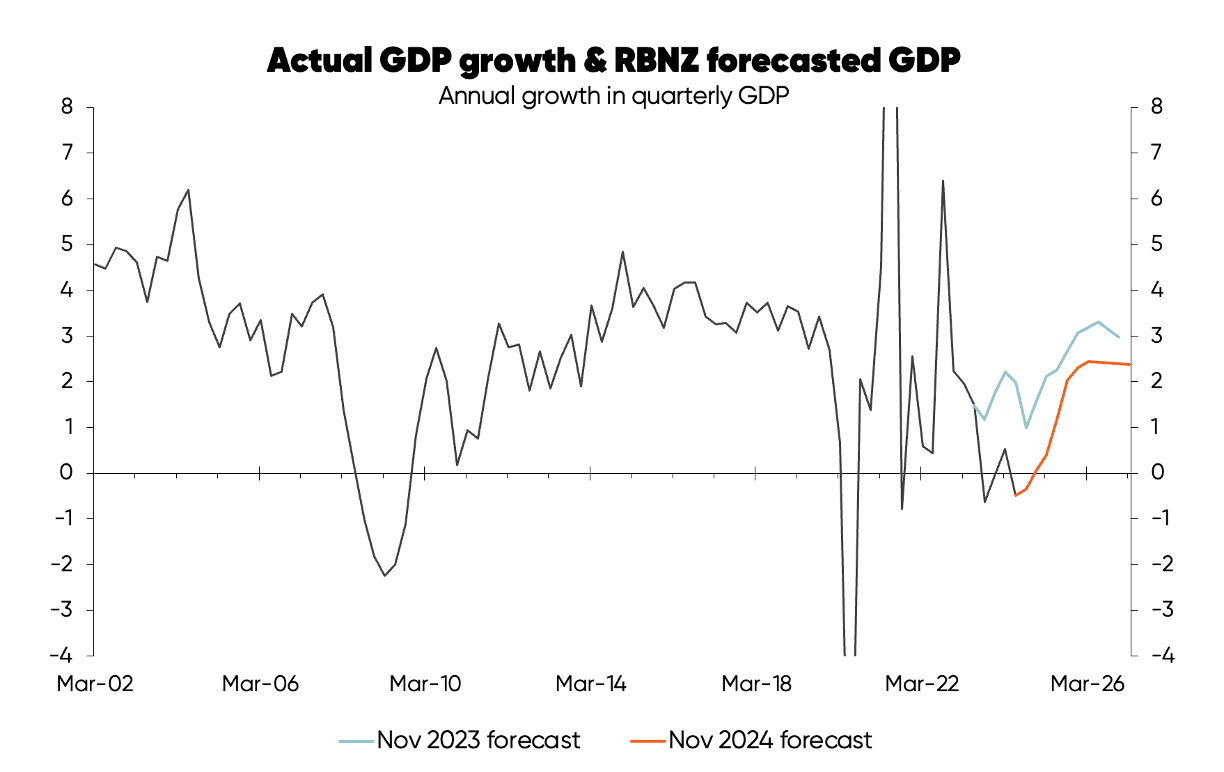

In November 2023, when the housing market was on its knees, the RBNZ forecast that GDP growth would muddle along at around 2% before improving to over 3% (blue line in the fourth chart). Instead, a recession occurred the RBNZ didn’t predict.

The RBNZ gives lip-service to the critical role the housing market plays in economic cycles and goes about over hiking and over cutting.

Ironically, despite planning to deliver lots more OCR cuts, including front-loading a number of big cuts, the RBNZ predicts only a modest recovery in economic growth over the next couple of years (orange line, fourth chart).

The RBNZ has learnt nothing from its past major mistakes and has even become worse at making OCR decisions and forecasting. Best you strap in for the ride because it looks like nothing will stand in the way of more monetary policy madness.

By Rodney Dickens, Managing Director, Strategic Risk Analysis Ltd www.sra.co.nz.