Get expert advice from our Wellington mortgage brokers - in person or online

We’ll compare your home loan options and give impartial, personalised advice. Get the best interest rates too.

Our Wellington advisers have been in the business over 20 years (previously known as The Home Loan Shop) so local knowledge is our specialty.

We're here to help you sort your mortgage

We’ll assess your situation and provide you with expert advice on how to structure your mortgage, reduce your payments and ultimately become mortgage-free faster. We’ll also answer those niggly questions, like:

- What’s the lowest interest rate in market?

- Fix or float, or a combination of both?

- Which bank is best for me?

- Can I avoid break fees?

- How much could I be saving?

Best of all, in most cases there is no cost to you because we get paid by the banks.

We write over $3 billion of mortgages per year, working with all the major banks.

Find the best mortgage rates.

Do it all online, in your pyjamas if you like, or pop in to meet with your adviser. We'll even make you a coffee. Whatever way you prefer, you’ll receive personal, impartial advice from your adviser and you’ll get a great mortgage rate too.

Fred

Always very easy to deal with and get things sorted. They do really take the hassle out of sorting and arranging to get my mortgage put together. It does feel like they are actually interested in helping and followed up after to make sure it was all good.

Why choose Squirrel to help with your mortgage?

Our advisers aren't incentivised

The advice you receive is impartial and because our advisers are paid the same no matter which lender you end up with, their only motivation is to make you better off.

Simplify things

It might seem like a minefield of jargon but it doesn’t have to be. Our experienced advisers take care of the hard bits so you can focus on what's important.

Save money

Having the right home loan solution can save you thousands. Plus we'll stay in touch and can regularly review your situation to make sure your mortgage is working for you.

A world of insights in one place

Keep up to date with the latest in the housing market, interest rates, economy, and our practical how-to's.

House prices are down 17%—so are we in a housing crisis?

Under normal circumstances, an almost 20% drop in house prices—more in some parts of the country—would be seen as disastrous. But that's exactly what's happened over the last three years, and most people have hardly batted an eyelid. Why is that?

Rodney’s Ravings: Why NZ is in dire need of new export winners

Growth has stalled across a number of our export industries in recent years—leaving a bit of a question mark over what exactly will be the key to New Zealand's future economic growth. Squirrel guest writer, Rodney Dickens, dives into the detail in his latest article.

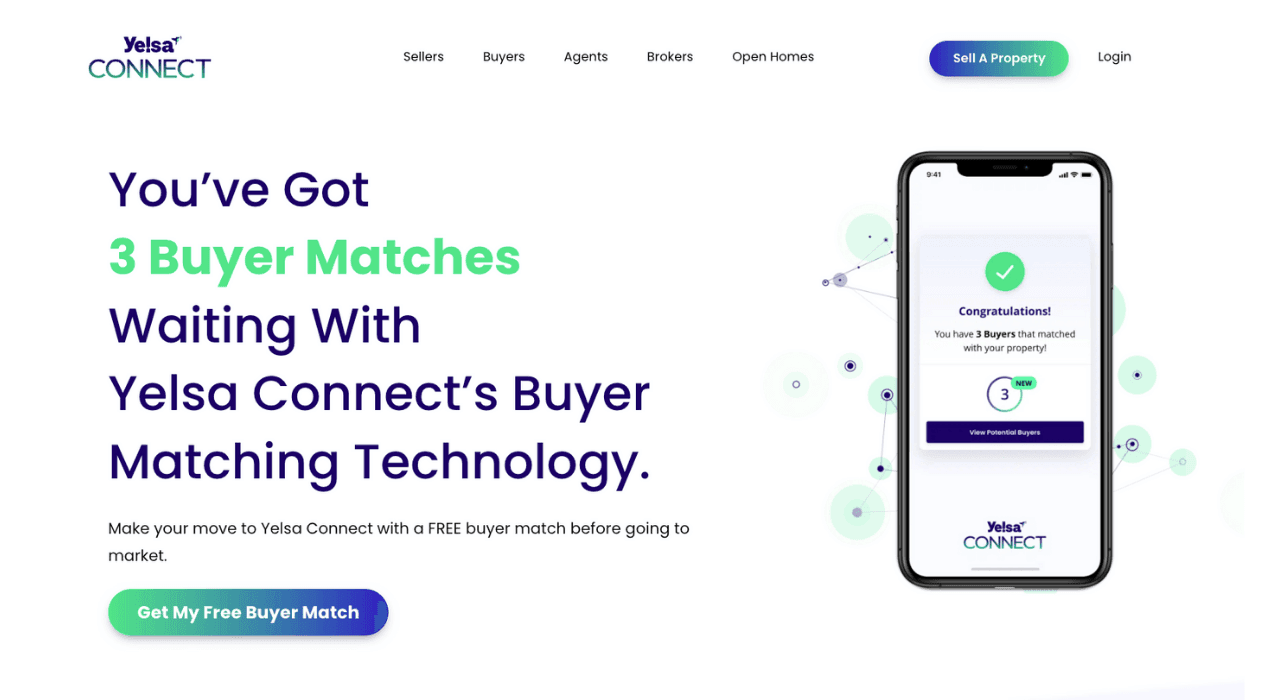

Yelsa Connect: Is this new real estate platform all it's cracked up to be?

Designed to bring greater transparency and efficiency to the process of buying and selling a house—saving both buyers and sellers time and money—Yelsa Connect is a new real estate platform with a whole lot of potential.

Ready to get started?

Start the application process online, or if you'd prefer to chat we're just a phone call away.

Swing by our Wellington Central office:

Or our Lower Hutt office:

Don’t just take our word for it

Ashley Paice

Great experience and very happy with the service.

Jonny

Mayank has been great to deal with. Our mortgage is floating for the first few days and then we will fix next week since there's been an OCR cut. Mayank was really good at explaining things especially the option of setting up part of the mortgage with a revolving credit.

Anonymous

Excellent

Peter

Shiva was amazing, this process was so so simple, so much better than direct with the bank. Thanks