Movements in NZ interest rates have been relatively closely linked to those in US interest rates over the last five years.

With the Fed scaling down plans for rate cuts—in part thanks to Trump’s inflationary policies (such as tariffs)—could it limit scope for NZ mortgage interest rates to fall further this year?

My assessment of the situation, including the links between NZ and US rates, and different economic developments, leads me to conclude NZ rates can largely keep falling even if the Fed halts rate cuts this year.

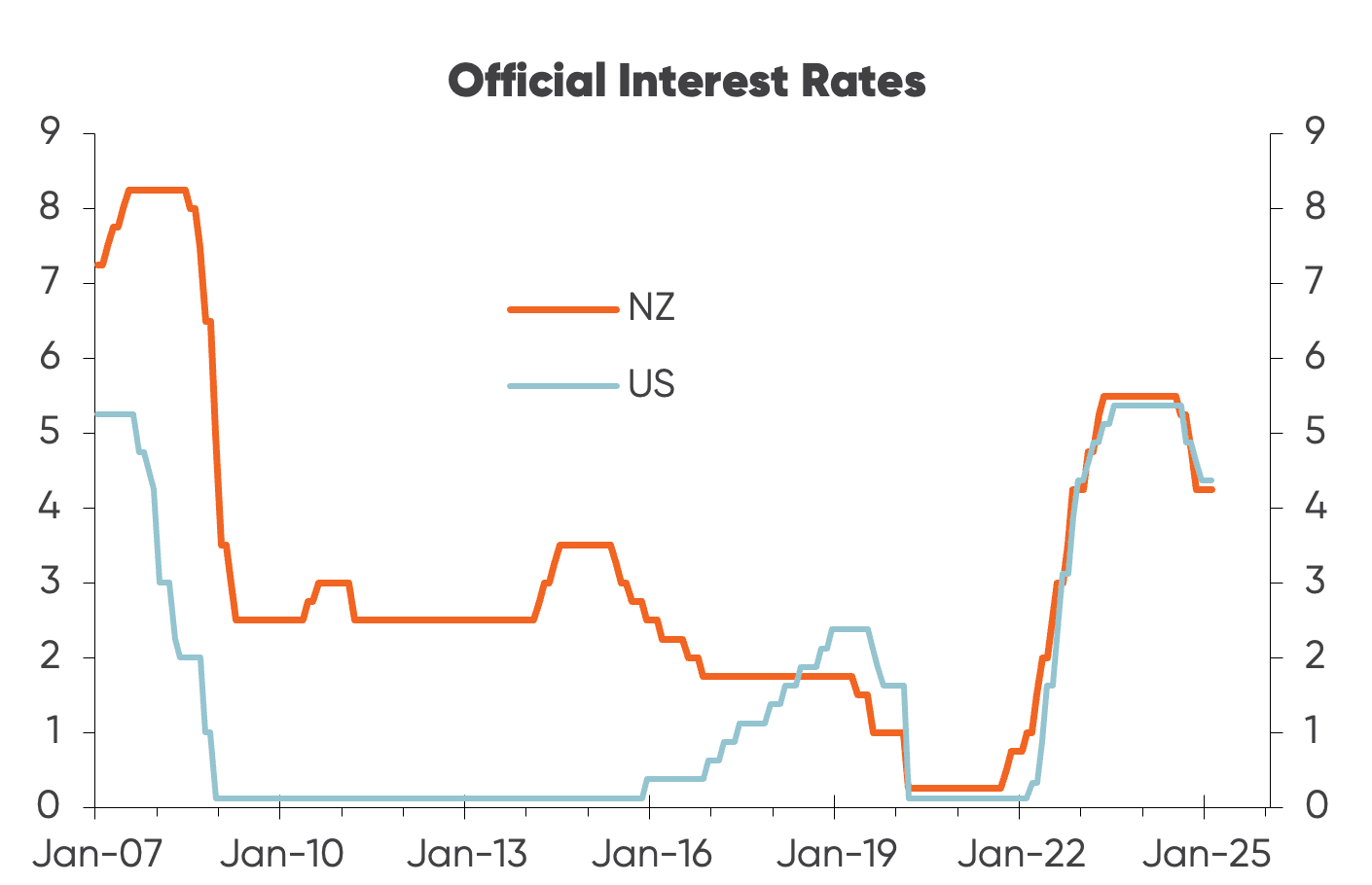

The first chart, below, shows the relationship between New Zealand’s OCR and the US Fed Funds Target Rate from 2007 to today. As you can see, they were very closely linked until 2015—but from mid-2015 to late-2018, they behaved completely differently.

The time period most relevant to what’s happening now was between 2015 and 2016, when the Reserve Bank cut the OCR while there was a small increase in the Fed Rate.

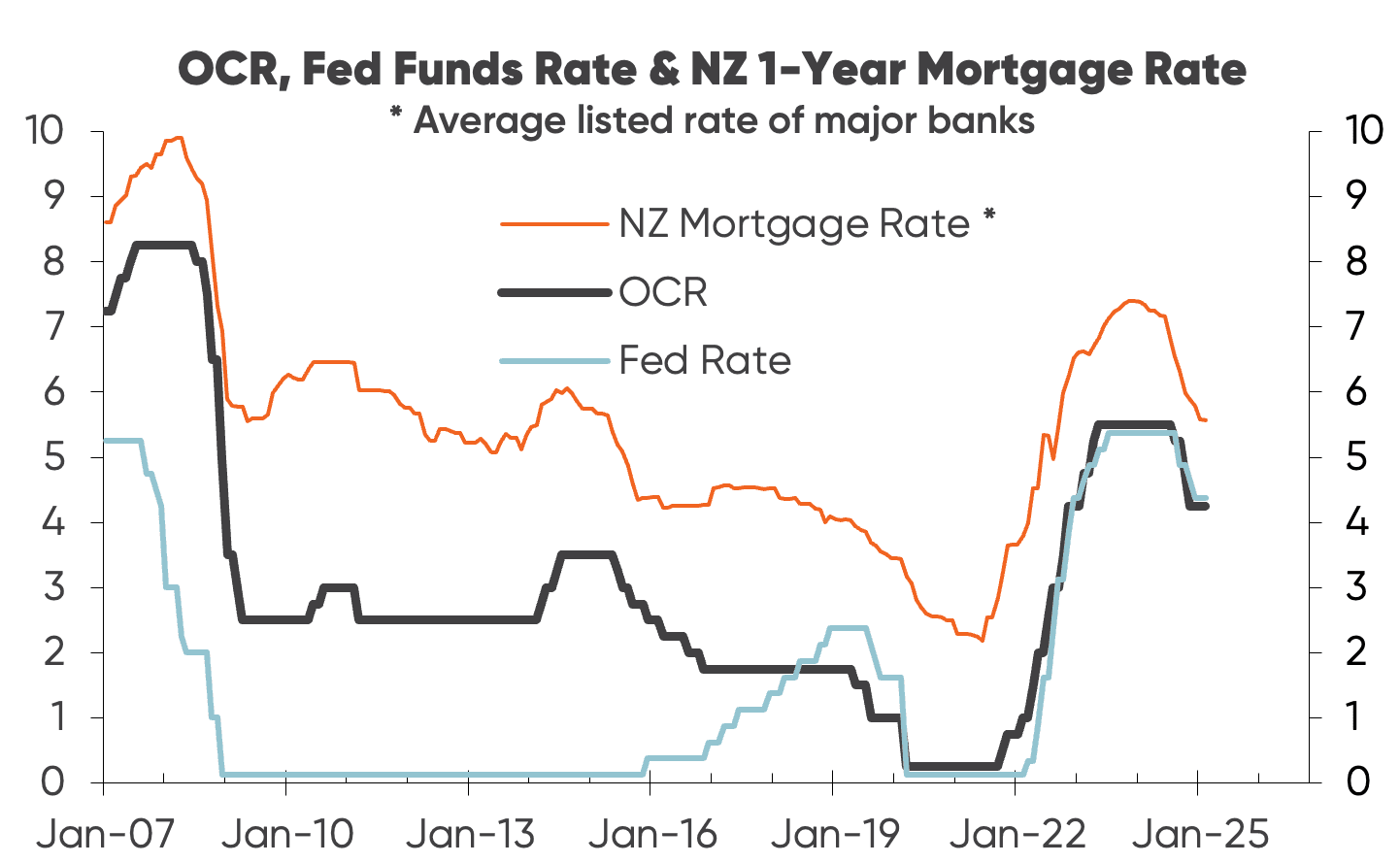

As you can see in the second chart, below, the average NZ one-year fixed mortgage rate fell in 2015 (despite no change in the Fed Rate) largely in anticipation of OCR cuts. That said, it did increase slightly, albeit temporarily, when the Fed started hiking aggressively in late-2016 and early-2017.

In general, the one-year fixed mortgage rate, as with other shorter-term rates, is much more influenced by what’s expected to happen with the OCR, rather than movements in the Fed Rate.

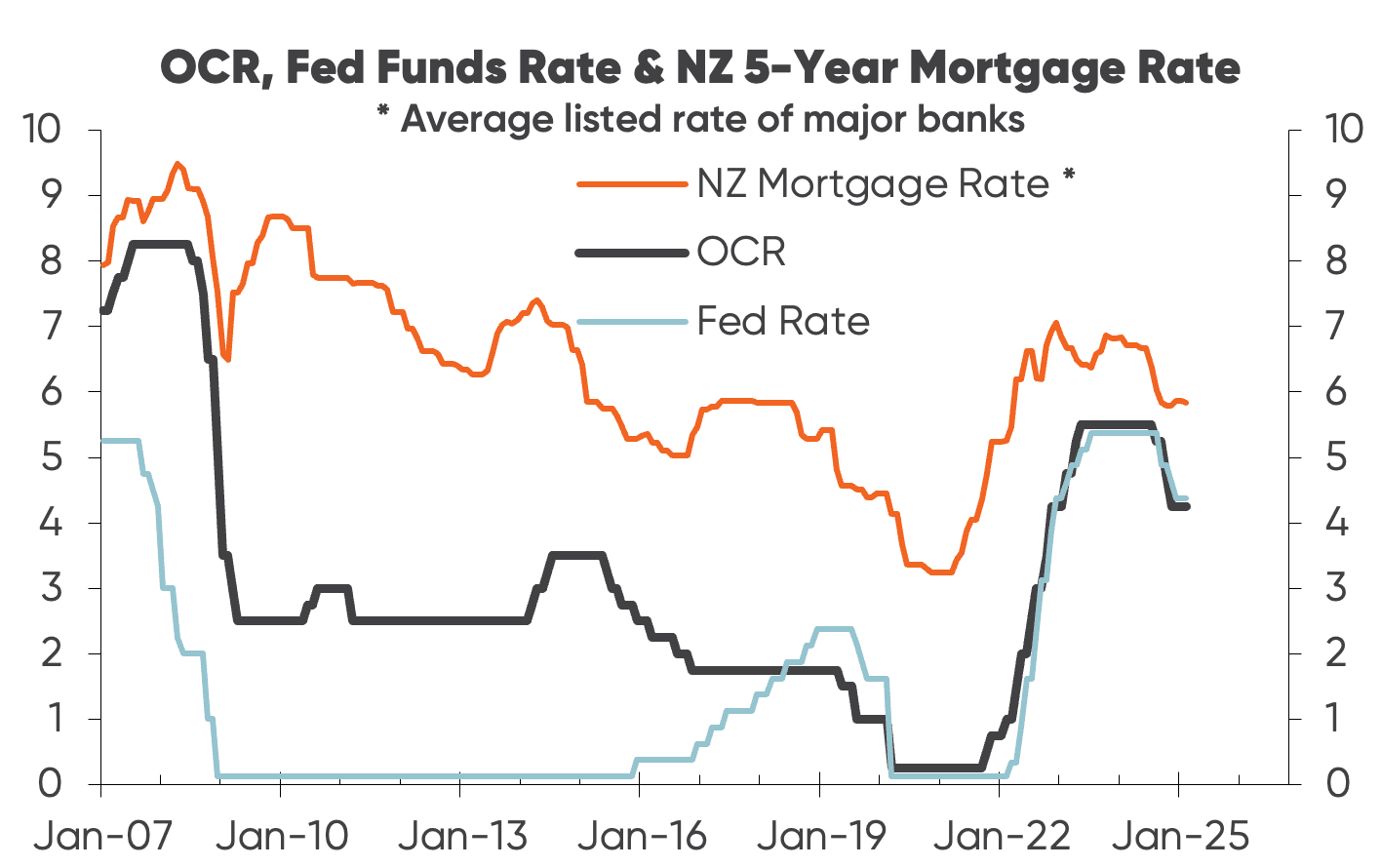

At the other end of the fixed-rate spectrum, there was a similar story playing out with the NZ five-year fixed mortgage rate over that same time frame. The five-year rate fell significantly in anticipation of OCR cuts in 2015 and 2016, but rose more than the one-year rate in response to the Fed hikes (see the third chart).

In my assessment, as long as the market expects the Reserve Bank to continue to cut the OCR, NZ mortgage rates will see further drops more even if the Fed stops cutting.

There are good reasons to expect better inflation news in NZ than out of the US, which would provide justification for the Reserve Bank to continue cutting the OCR roughly as it plans from 4.25% at the time of writing to around 3% by mid-2027.

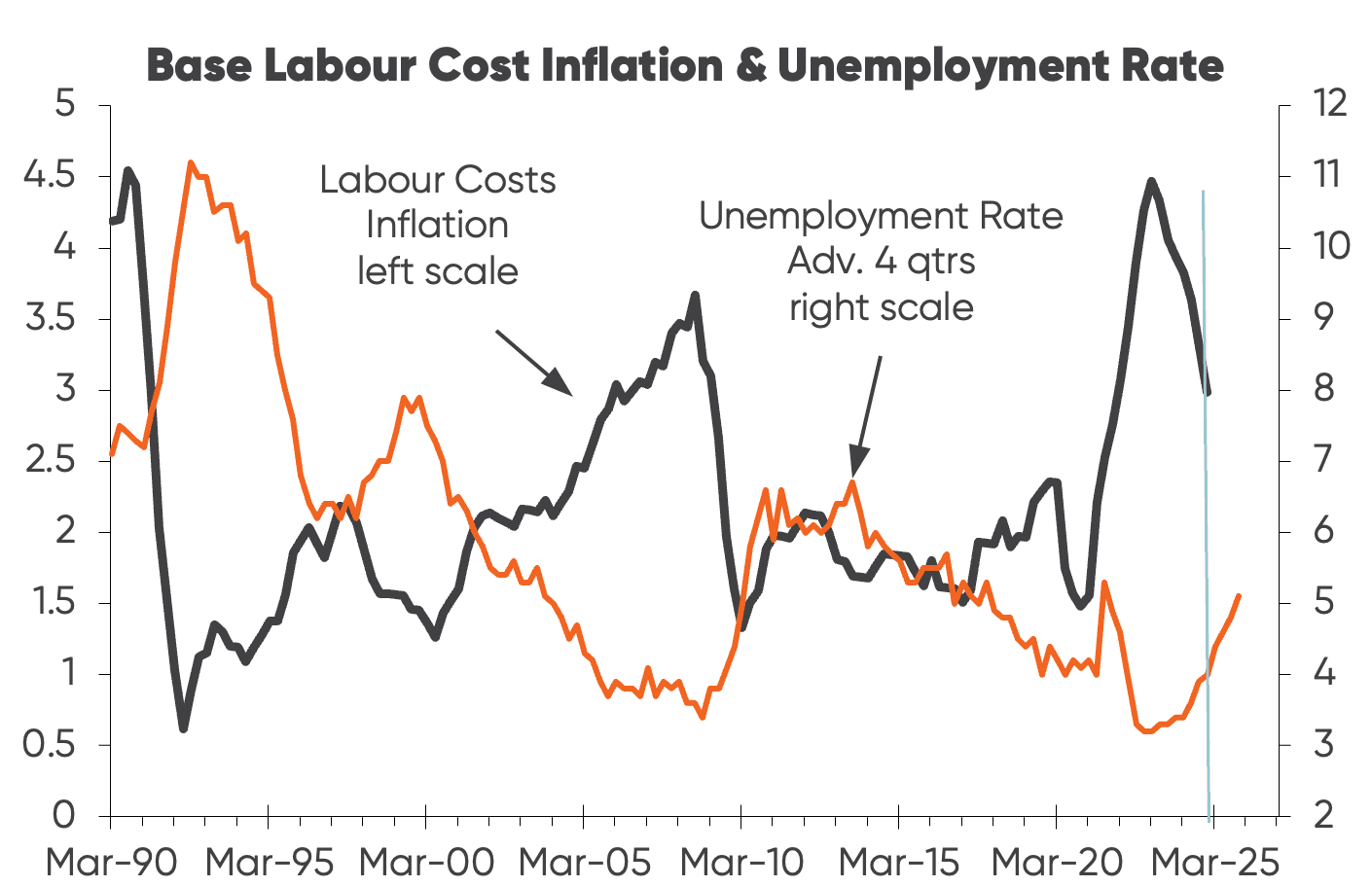

Base labour cost inflation is central to core CPI inflation in NZ. After a year’s lag on the increase in the unemployment rate, it has started to fall and should fall significantly more over the next year (see the fourth chart).

Leading indicators point to the unemployment rate increasing to around 5.5% by mid-year. This will be more than enough to fully fix NZ’s inflation problem and in response the Reserve Bank is likely to continue to cut the OCR.

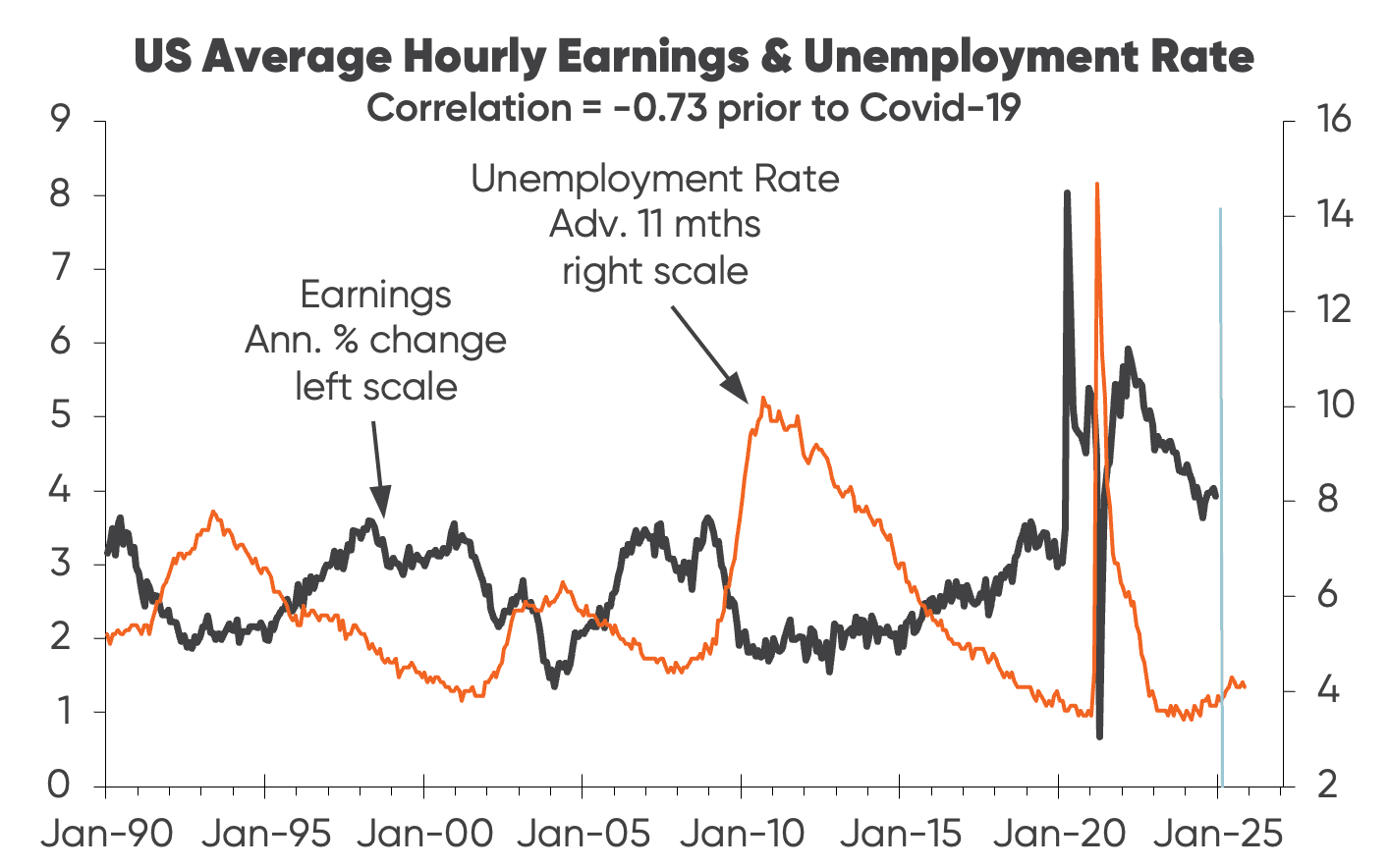

By contrast, the increase in the US unemployment rate has stalled, as has the fall in wage inflation (as shown in the fifth chart, below) and leading indicators suggest the unemployment rate is more likely to fall slightly this year, rather than increase.

Even before Trump’s potentially inflationary policies impact there are good reasons for the Fed to (at a minimum) scale back plans for more rate cuts.

There is quite a bit of uncertainty about what policies Trump pursues, but I don’t expect this to change the case for more OCR cuts in NZ. Therefore, I believe there is good reason to expect mortgage rates and other interest rates to fall more over the next year.

By Rodney Dickens, Managing Director, Strategic Risk Analysis Ltd www.sra.co.nz.