Rodney's Ravings: High immigration won't be a magic fix for labour shortages

Guest post by Rodney Dickens

In the wake of New Zealand’s border re-opening last year, rolling 12-month migration numbers have rebounded to pre-Covid levels – driving spikes in net migration and population growth.

That’s been caused mainly by an influx of Kiwi returning from their OEs, immigrant workers, long-term visitors, and students...only some of whom add to labour supply.

The Reserve Bank (RBNZ) has suggested the spike in immigration “has assisted to ease labour shortages”. And it seems to play an important part in the RBNZ’s prediction that the unemployment rate will surge from 3.40% to a peak of 5.40% by the end of 2024, contributing to lower labour cost and CPI inflation.

The idea that immigration will help to fix New Zealand’s labour shortages is prevalent, and flawed

If increased immigration boosted labour supply more than it does labour demand, large increases in immigration should (in theory) be associated with higher unemployment rates, as the RBNZ is currently predicting.

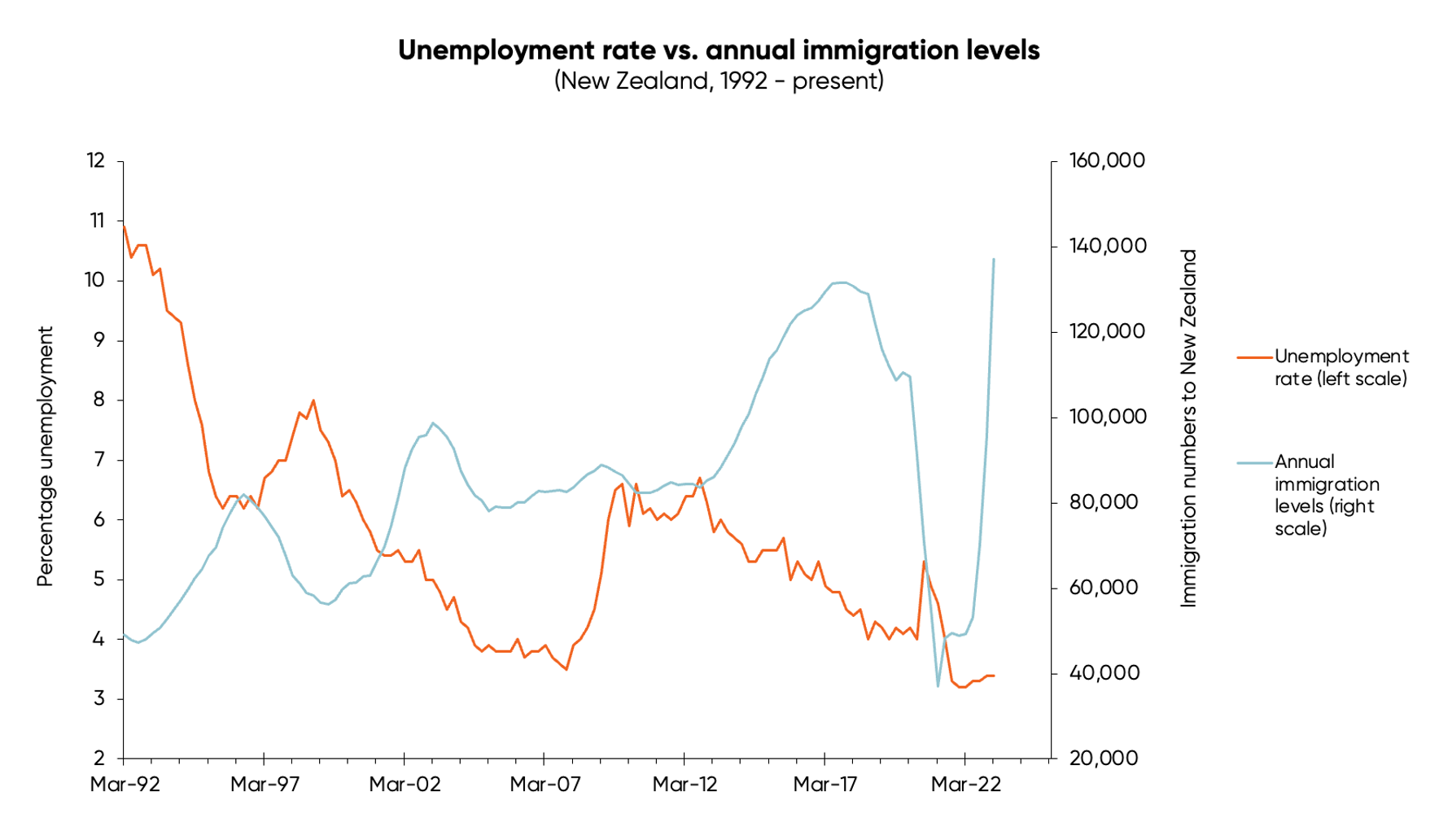

Unfortunately, the chart below shows the opposite to be true.

Ignoring the Covid era, and the unique circumstances around it, the previous three periods of surging immigration since 1992 have all been associated with a falling unemployment rate or tighter labour market, not a rising unemployment rate.

History suggests the RBNZ’s view is not only dubious, but is the opposite to what should be expected as a result of a surge in immigration.

What is the RBNZ overlooking?

The obvious! More working visa immigrants and returning Kiwi arriving in the country increases the supply of labour and will fill some critical job vacancies. However, they will also add to demand for goods, services, and employees.

Any non-working immigrants add to demand, without adding to supply. And the need for most new immigrants to buy things like whiteware, and other furnishings, upon getting settled into the country, adds quite a bit more demand than supply (including demand for labour).

For some firms, high immigration will solve labour shortages, but from an economy-wide perspective, immigration adds more to demand than supply, making labour shortages potentially worse.

This fits with previous experience illustrated by the chart above although other factors will play a part in the inverse relationship it shows between immigration and unemployment levels.

Perhaps this time will be different given the surge in immigration is both sharper and driven by different things than those we’ve seen previously. There could also be lags in the time it takes for the spike in immigration to boost spending and demand for labour – and maybe, for a while, the sharpness of the spike will mean it helps to alleviate labour shortages.

I struggle to see the RBNZ’s view being right for more than a brief period

In the past the unemployment rate has only increased in the manner the RBNZ is predicting in response to full-blown recessions, where we've had a 2.00% or larger fall in GDP.

A rough rule of thumb is that if GDP falls by 2.00%, the unemployment rate will increase by 2.00% (so, from 3.40% to 5.40% for example).

The RBNZ is only predicting a 0.40% fall in GDP this time round, hardly a recession; highlighting the significance it's placing on high immigration to fix our acute labour shortages.

But the RBNZ’s blind pursuit of OCR hikes – without proper consideration of the fallout in the pipeline – means the recession will likely be worse than it predicts; I’d expect by as much as a factor of four.

By Rodney Dickens, Managing Director, Strategic Risk Analysis Ltd www.sra.co.nz.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.