Opinion: The RBNZ needs to start cutting interest rates, ASAP

Post by David Cunningham - Squirrel CEO

In a nutshell:

- Given how popular fixed-rate loans are in New Zealand, it takes one to two years for monetary policy decisions to trickle through to the economy, as people roll off existing loan terms.

- Decisions made on interest rate settings today will largely impact inflation outcomes in 2025 and 2026, not 2024.

- New Zealand’s economy is undoubtedly weak — and it has been for over a year, especially on a per capita (or per person) basis.

- The Reserve Bank’s (RBNZ) interest rate settings, although unchanged for 10 months, are still having a tightening effect on the economy. At current levels, there’s another 1% increase to the average mortgage rate still to come, which would take a further $3.5 billion p.a. out of Kiwi homeowners' wallets.

- Inflation is tracking down fast. There are some BIG numbers to drop out of the CPI calculation by September 2024, including the 1.8% inflation figure from the September 2023 quarter.

- In my view, the Reserve Bank Monetary Policy Committee should start lowering the Official Cash Rate (OCR) at the next announcement, on 10 April 2024, with a 0.25% reduction.

Being blunt, the RBNZ is almost single-handedly responsible for reducing New Zealanders' living standards over the last 18 months

Back in 2022, it set out to inflict a recession on New Zealand in order to tame inflation. And now, in light of the latest GDP stats out just last week, it looks like it’s succeeded in that mission.

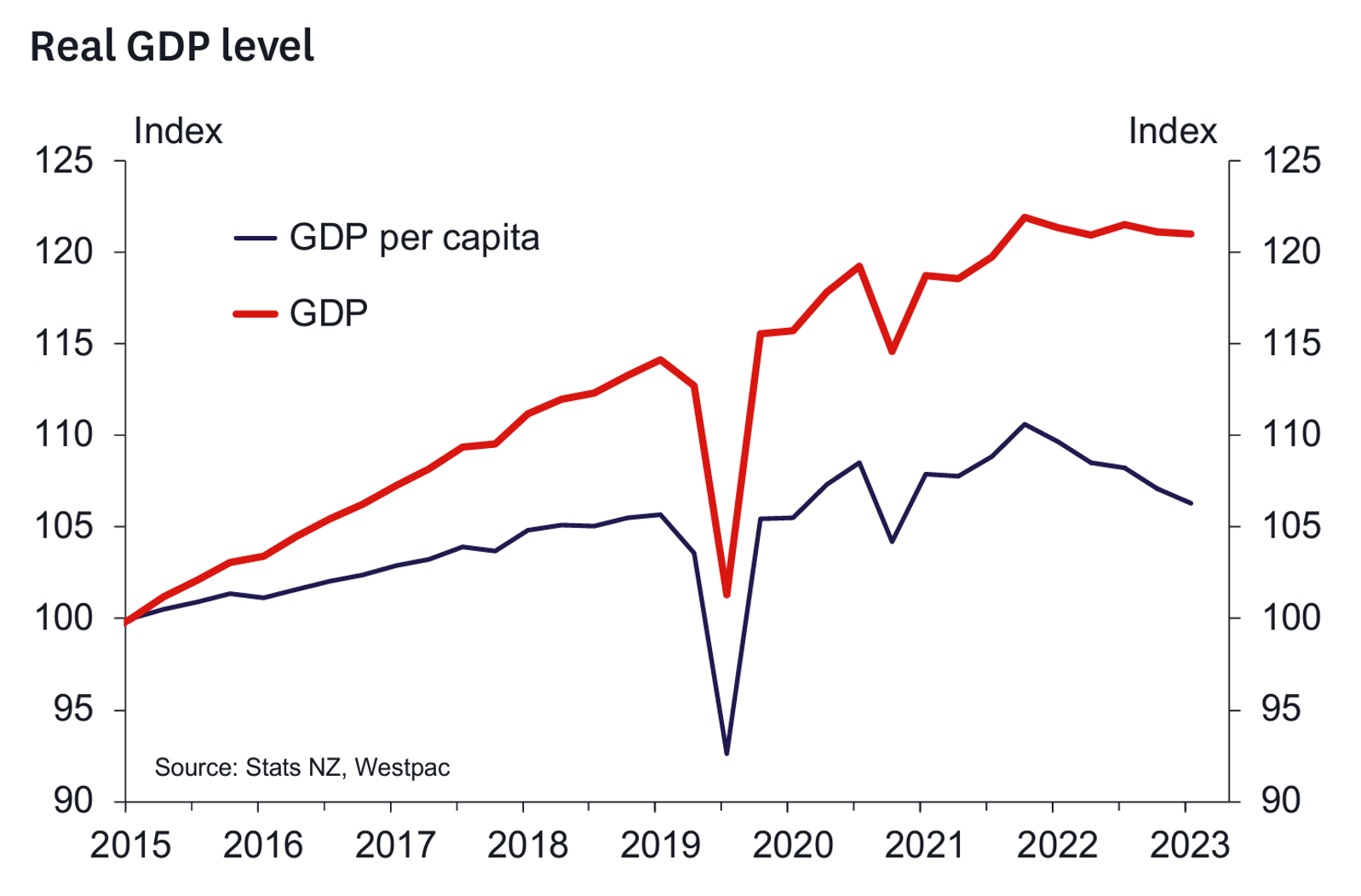

In fact, per capita GDP is almost back to where it was in 2019, five years ago (the black line on the graph below).

In an excellent article for Squirrel, economist Rodney Dickens argues that the RBNZ is normally slow to realise there is an inflation problem, and equally as slow to recognise when it’s done enough damage to tame inflation.

“Monetary policy is more like a sledgehammer than a scalpel and the RBNZ’s inept use of it makes economic cycles more extreme. It means there are reasonably protracted periods of solid GDP growth followed by recessions.”

He points out that monetary policy changes take up to 2 ½ years (yes, years) to have any impact on inflation.

By implication, that means the RBNZ’s ability to do anything more to influence inflation outcomes over the next year is — at this stage — practically non-existent.

So, what’s happening right now with monetary policy?

To put it simply, monetary policy is tightening at a frightening pace.

This is because Kiwi prefer fixed interest rates on their home loans. As Rodney points out, it takes a couple of years for the impact of rate hikes (or cuts, for that matter) to fully impact households.

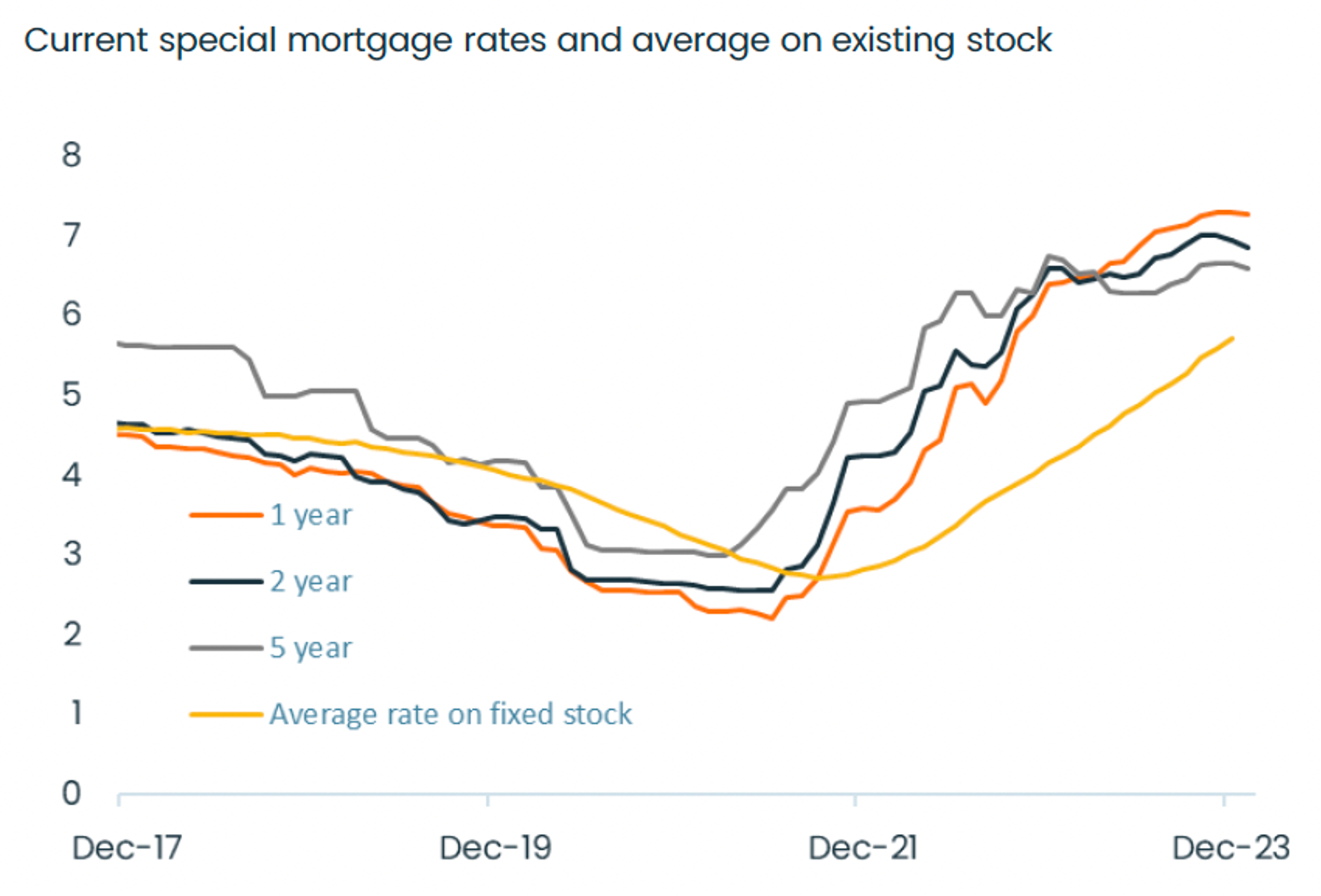

Take a look at the below graph from Core Logic, based on Reserve Bank data:

Source: Core Logic, RBNZ

The top three lines are current fixed home loan interest rates — roughly what you’ll pay on a new home loan, or when you refix after your current term comes to an end. They’re around 7%.

The yellow line is the average interest rate Kiwi are paying on their fixed-rate home loans right now. It’s currently sitting at 5.8%.

The average mortgage rate got right down as low as 2.7% a couple of years ago, meaning it’s already climbed by a little over 3%. But it’s still got over 1% to go to get to the level of current rates.

In other words, about a quarter of the impact of all those OCR hikes we’ve had in this latest round (totalling 5.25%) is still to be felt.

Don’t kick Kiwi when they’re down and out, Mr Orr

New Zealand has been one of the worst-performing economies in the Western world over the last couple of years.

GDP (a.k.a. the country’s collective output) has fallen by about 4% per person since September 2023, and is back near 2019 levels.

And there’s further evidence of all that economic pain everywhere you turn:

- New Zealand’s GDP (output) is down 0.3% over the last year despite roughly 3% population growth.

- GST receipts are well below even recent forecasts.

- Business tax receipts are also below forecast – reflecting lower profits.

- Retail sales volumes were down 4% in 2023, in spite of that approximately 3% population growth.

- Everyday Kiwi and businesses are struggling. According to Centrix:

- Almost half a million consumers are behind on their payments to lenders and suppliers (e.g. banks, telcos, utilities).

- Over 12,000 borrowers have been flagged by lenders as being in financial hardship, an increase of 32% over the last year.

- 22,000 borrowers are behind on their home loans, up 16% over the last year.

- Business credit defaults are up 28% over the last year.

I could go on, but you get the point.

So, the reason we’re all feeling worse off is because, objectively, we *are*.

In my opinion, the RBNZ needs to start cutting the OCR, now

Inflation is a silent destroyer of wealth.

That’s why it was totally appropriate for the RBNZ to take aggressive action post-Covid, hiking the OCR to rein in our booming economy and inflation.

But now, the job is done. In fact, it's almost certainly overdone.

From here on out, the RBNZ needs to be looking to the future and taking action that will be right in a year or two, when the impact of any changes made now will be felt by Kiwi households.

Talk of holding out any longer on cuts just to be sure inflation is slayed is unnecessary — and the impact of that approach would be devastating for New Zealand and New Zealanders.

Still, that's the widely-held stance among bank economists, many of which are picking rate cuts to start in late 2024, with a couple even looking to 2025.

I suspect this is partly reflective of what they think the Reserve Bank will do, rather than what it should do — and there’s a real opportunity for this group to be more proactive in arguing for different monetary policy settings.

In my view, which is very much at odds with the above, the Reserve Bank’s Monetary Policy Committee meeting in April should be the start of a gradual cycle of interest rate cuts over the next couple of years.

And so that’s why I’m calling for a 0.25% OCR cut on 10th April 2024.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.