A submission to the Reserve Bank on proposed DTI limits

Post by John Bolton (Founder) & David Cunningham (CEO)

In a nutshell:

- The Reserve Bank (RBNZ) recently asked for feedback on its proposed DTI, or debt-to-income, lending restrictions – to be introduced later this year.

- Squirrel is broadly supportive of the introduction of DTIs.

- Squirrel believes the proposed settings for owner-occupiers are appropriate.

- Squirrel believes that the proposed settings for property investors are significantly too restrictive and, from a risk perspective, are not supported by the facts provided by the Reserve Bank.

- Squirrel also submitted that the LVR threshold for property investors should be set at the same level as for owner-occupiers, but with a lower “speed limit”.

At the start of the year, the Reserve Bank of New Zealand (RBNZ) invited feedback on a new set of lending restrictions it’s looking to introduce later in 2024.

Debt-to-income ratios – DTIs for short – will work by limiting how much prospective homeowners can borrow to buy a house, based on a multiple of their household income.

The banks will also have the discretion to do a certain amount of their lending (20%) over and above these caps, meaning there’s still wriggle room for really credit-worthy buyers hoping to borrow more.

DTI limits will vary depending on the purpose for buying the property, set at 6 for owner-occupiers (those planning to live in the house) and 7 for property investors (where the house will be a rental).

According to the RBNZ, it’s chosen these specific limits with the goal that they’ll have minimal impact at times when the housing market is operating as normal and be more restrictive at times when things start to get out of hand.

As part of the consultation process, the RBNZ sought feedback on several aspects of its DTI proposal – and, naturally, the team at Squirrel had something to say.

What’s our take on the new DTI limits?

Broadly speaking, we think introducing DTI limits is a really good idea.

Along with all the other lending restrictions that our banks are subject to in New Zealand, they’ll be an effective and valuable tool to help bring more stability to our housing market.

Diving into the specifics, a DTI limit of 6 for owner-occupiers feels appropriate. All the data suggests that capping lending at this level will do an excellent job of limiting financial stress for this group at times of higher interest rates and won’t be too much of a handbrake on buyer activity until house prices start to ramp up.

But beyond that, we have several concerns about the unintended impact of the proposed restrictions for property investors and business owners.

These are the concerns we raised with the RBNZ as part of our submission:

1. The proposed DTI limit of 7 for property investors feels too restrictive

Remember that the goal with DTI limits is that they’ll – more or less – only really come into play when the housing market is heating up, limiting how much and how quickly buyers can increase their borrowing power to stop prices from getting out of control.

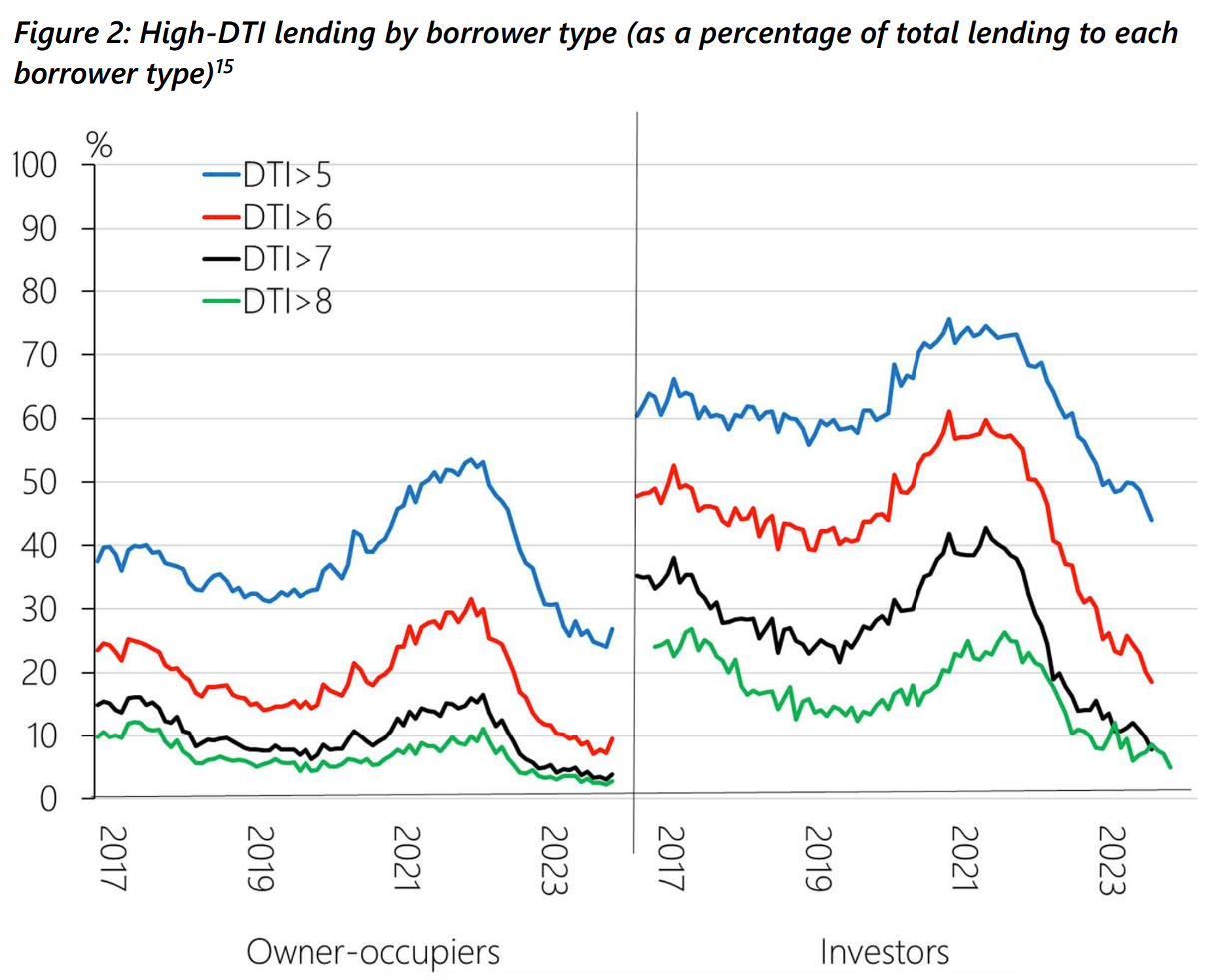

Well, the chart below (from the RBNZ) depicts levels of “high-DTI” lending activity over the last few years, i.e. the amount of lending that’s occurred above different potential DTI limits. The black line on the right is what we’re looking at here, representing a DTI of 7 for investors.

You can see there have been large periods (even excluding the 2021 boom) where a significant proportion of banking lending to property investors has been over the proposed limit, well outside the 20% buffer the banks will have to cater to this sort of thing.

And actually, the only time it’s been comfortably within that limit is from 2022 onwards – when many factors, including removing tax benefits on rental properties, took investors out pretty much completely. In other words, the last two years aren’t a good measure of how restrictive (or not) the proposed limits could be.

Our concern is that a DTI of 7 for this group has real potential to limit investor buying activity at all periods in the housing market cycle, so we recommended that a limit of 8 would be more appropriate.

2. The banks are hyper-conservative when implementing lending restrictions – so the “speed limit” they work to will likely be even lower

Banks are conservative beasts by nature, and in our experience, they’ll always err on the side of caution when they implement this sort of thing internally.

The RBNZ might have proposed a 20% “speed limit” on high-DTI lending, but the banks will probably work to something closer to 15%-17%. That means even less appetite to cater to investors who need to borrow more, making the situation even more restrictive.

Again, the recommendation we submitted was either to increase the DTI limit for investors to 8 or consider a speed limit of 30% for this group.

3. Existing property investors may be caught out by the new rules when they come to sell

Like most lending restrictions, DTIs won’t just apply when you buy a property – but your situation will also be reassessed when you want to offload a property, or if you need to make other material changes to your lending.

The concern we outlined to the RBNZ is around investors who weren’t subject to DTI restrictions when they bought but will then become subject to them when they sell.

The risk here is that investors may unwittingly find themselves outside the limits, and vulnerable to the banks taking action (by claiming sale proceeds) to reduce their debt and bring them back within the DTI rules.

If you’ve sold a property to use that money for something else, that will create a lot of pain.

It can potentially create an even bigger mess for borrowers with loans across different banks. Because DTIs are calculated across your entire portfolio (rather than just property-by-property), if you’re over the limit with one of your lenders, you’re over the limit with all of them.

4. There are certain exemptions to the new DTI rules, and some of those (like with new builds) throw up potential issues too

New builds will be exempt from DTI restrictions, as will homes purchased under the Kāinga Ora First Home Loan scheme (for first home buyers), and refinancing deals where the loan amount stays the same.

The issue with this is that the new build definition only applies at the time of purchase – so what happens when an investor wants (or needs) to make changes to their portfolio in future, and that triggers a reassessment? Will they again find themselves inadvertently outside the DTI limits?

Given the challenges this could create, our submission questioned the logic behind the new build exemption – and encouraged the RBNZ to think through how it plans to manage the implications for property investors.

5. There are huge potential consequences for business owners when it comes to leveraging their property portfolio to access business capital, particularly during cyclical downturns

In New Zealand, there’s a huge crossover between business owners and property investors – and it’s not uncommon for this group to tap into their property portfolios to access additional business capital when needed.

The very nature of business is that earnings are cyclical, whether due to seasonal fluctuations in a particular industry or wider economic downturns.

And it’s during these downturns, when income is down, and cash flow is tight, that business owners are more likely to need access to capital but less likely to be able to meet DTI restrictions.

Especially if banks are already operating at the limit of their high-DTI lending, which feels likely for all the reasons we’ve mentioned already, the new rules could seriously restrict access to a key source of business capital when it’s most sorely needed.

6. The RBNZ also sought feedback on its new proposed LVR (or loan-to-value ratio) settings for owner-occupiers and investors, and we had some thoughts on that too

LVRs are the rules which say you have to be able to front up with a certain percentage of a property’s value saved as a deposit – with the banks given some flexibility to lend over this figure. The new settings the RBNZ is looking to introduce are:

- For owner-occupiers: up to 20% of lending can be done over an LVR of 80 per cent (i.e. with a deposit of less than 20%)

- For property investors: up to 5% of lending can be done over an LVR of 70 per cent (i.e. with a deposit of less than 30%)

Our take on these settings is that the limit and threshold for investors feels overly restrictive when coupled with DTI limits – and could ultimately serve to reduce the number of available rental properties, and drive up rents (hitting lower-income Kiwi hardest).

We submitted to the RBNZ that it would be more appropriate to set the property investor LVR threshold at the same level as for owner-occupiers, at 80% – with a 5% cap on lending over and above that threshold.

So, where to from here?

Submissions were due earlier this month and will be published on the RBNZ website at some stage in the coming weeks.

The RBNZ is planning to implement DTI restrictions sometime around the middle of this year – so we can likely expect their outcome of their deliberations to be delivered in the next few weeks.

If you're keen to read our full submission to the RBNZ, you can check out our letter here and our supporting documentation here.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.