Rodney's Ravings: NZ interest rates should fall ahead of US rates

Post by Rodney Dickens

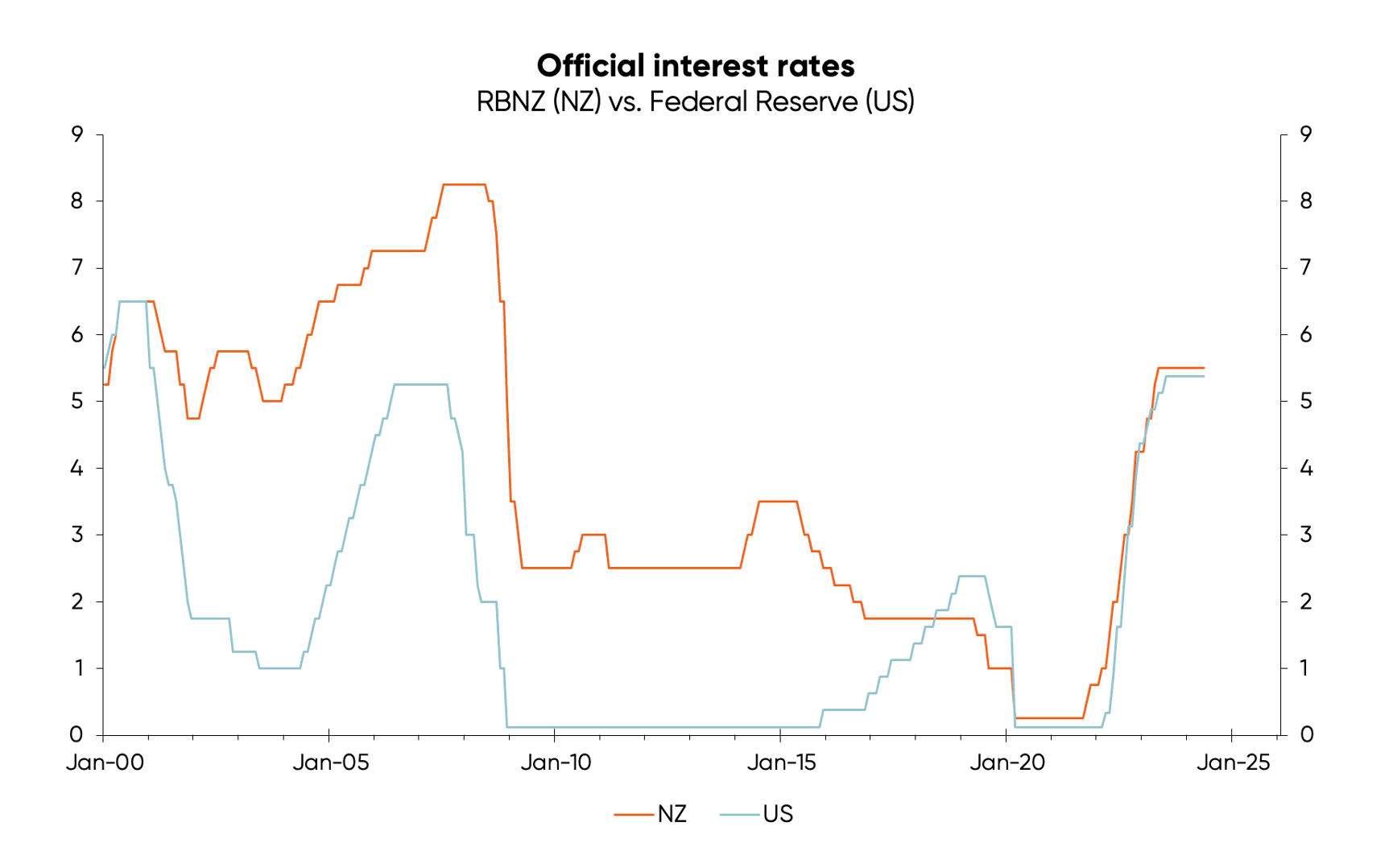

US interest rates can play a major part in driving NZ interest rates, especially around major global events like Covid and the GFC. However, when NZ economic fundamentals differ significantly from those in the US, local developments (rather than US ones) will drive what happens with local interest rates.

Despite similar interest rate surges since 2020, NZ is experiencing a much greater level of economic pain than the US. This means NZ is making far more progress towards taming inflation, which implies that our interest rates should fall earlier.

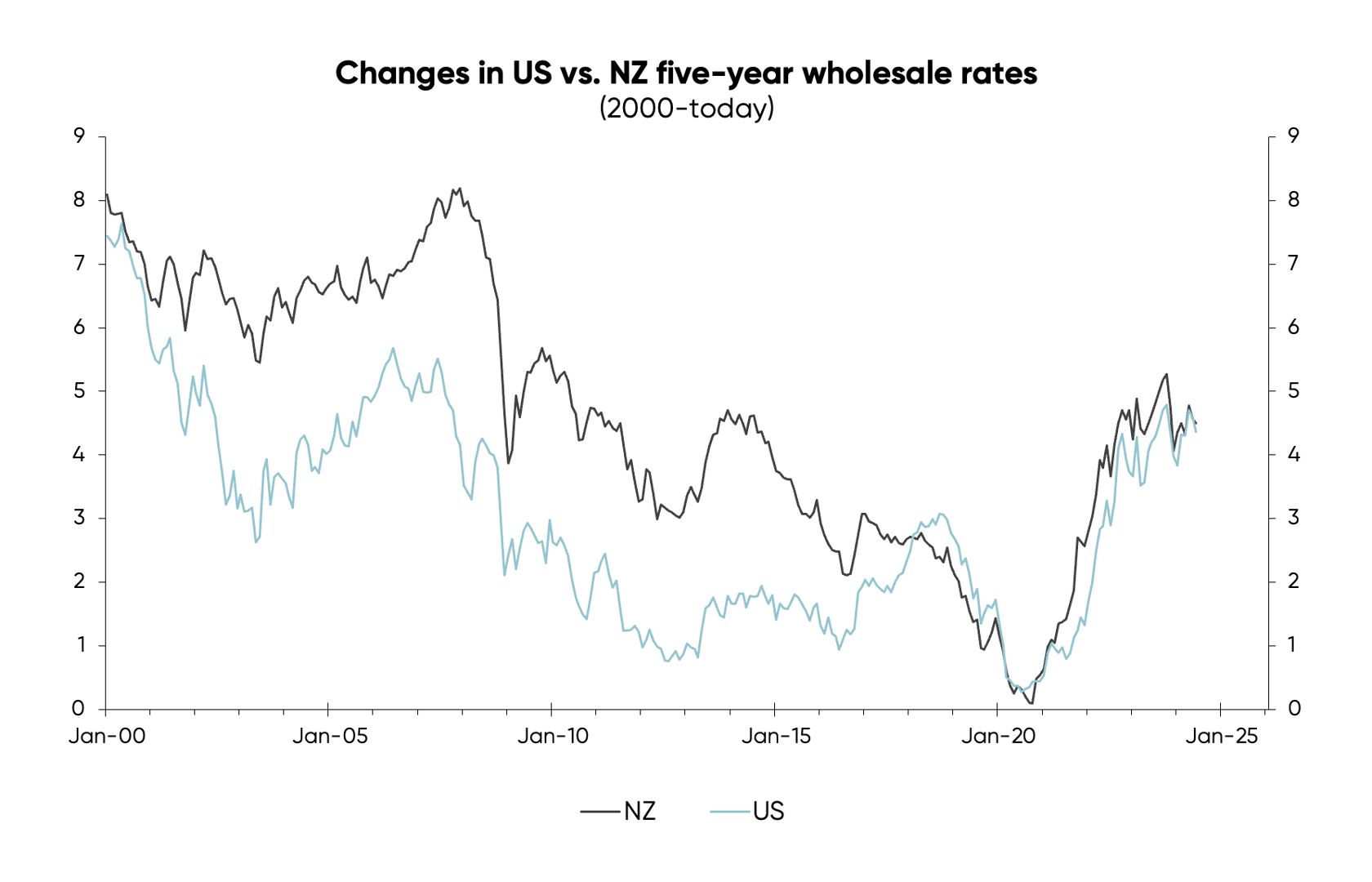

Historically, and especially over the last few years, there has been quite a close link between NZ and US interest rates. You can see this clearly in the first chart below – tracking changes in 5-year wholesale rates, which are one of the main drivers of what happens with mortgage rates.

If concern about inflation in the US intensifies (or abates), US market-driven interest rates like the 5-year swap rate rise, will rise (or fall) in response—and the NZ 5-year swap rate largely follows suit.

However, if there isn’t a shock and NZ’s economic fundamentals—GDP growth and inflation—differ significantly from US ones, NZ interest rates can behave differently.

For example, in 2001, when the Fed cut interest rates dramatically, the Reserve Bank here in New Zealand cut the OCR much less. The second chart below shows that market-driven wholesale interest rates followed these same trajectories—with the US 5-year swap rate falling much further than the NZ rate (first chart).

Between the first and second charts, you can also see that when the Fed hiked from late-2015 to early-2019, while the RBNZ first cut then left the OCR unchanged (per the second chart), there was also major divergence in the behaviour of the respective 5-year swap rates—again, reflected in the first chart.

The tendency for NZ interest rates to follow US rates is only the case if the economic fundamentals are similar. But if the key fundamentals differ significantly, the link breaks down and NZ interest rates will part company with US rates, although even then there can be a bit of day-to-day linkage.

The NZ and US are both currently facing their biggest inflation battles in 30 years. As a reflection of this, interest rates have risen similarly in both countries following the Fed and RBNZ having played significant parts in fuelling inflation via super-low interest rates.

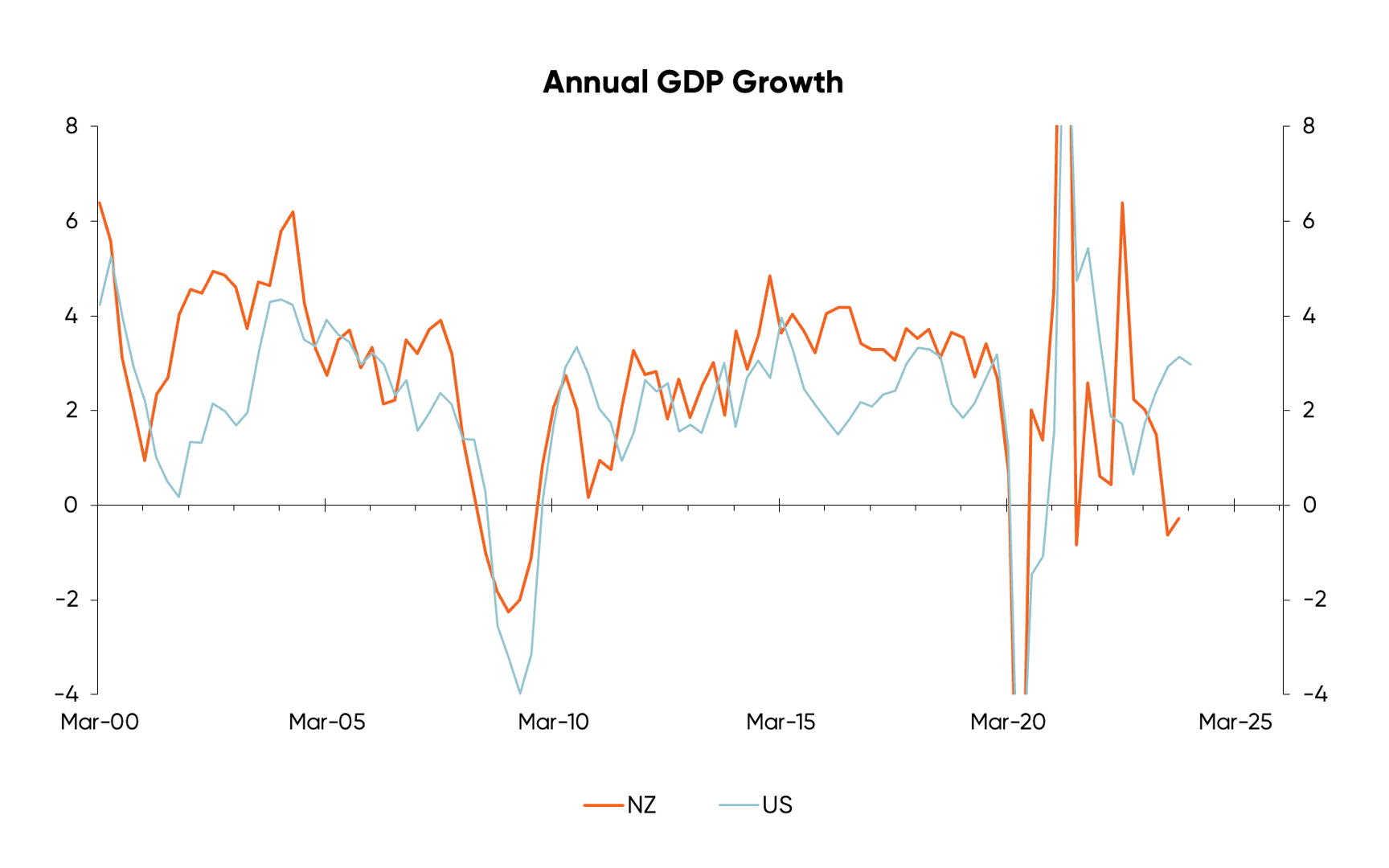

Similar fundamentals have justified similar behaviour in terms of interest rates. However, one quite big difference that has emerged in the last year is a major difference in the economic fallout that has resulted from the similar increase in interest rates. NZ is now in a recession while US GDP growth has been comparatively resilient, as depicted in the third chart below.

Despite similar interest rate increases, the US hasn’t experienced anywhere near as much economic pain as NZ, largely because most existing mortgage holders have been sheltered by 30-year fixed rates while most NZ existing mortgage holders have experienced massive increases in interest costs. Only a small portion of existing US mortgage holders are currently experiencing a massive rise in interest costs because very few US homeowners have adjustable mortgage rates.

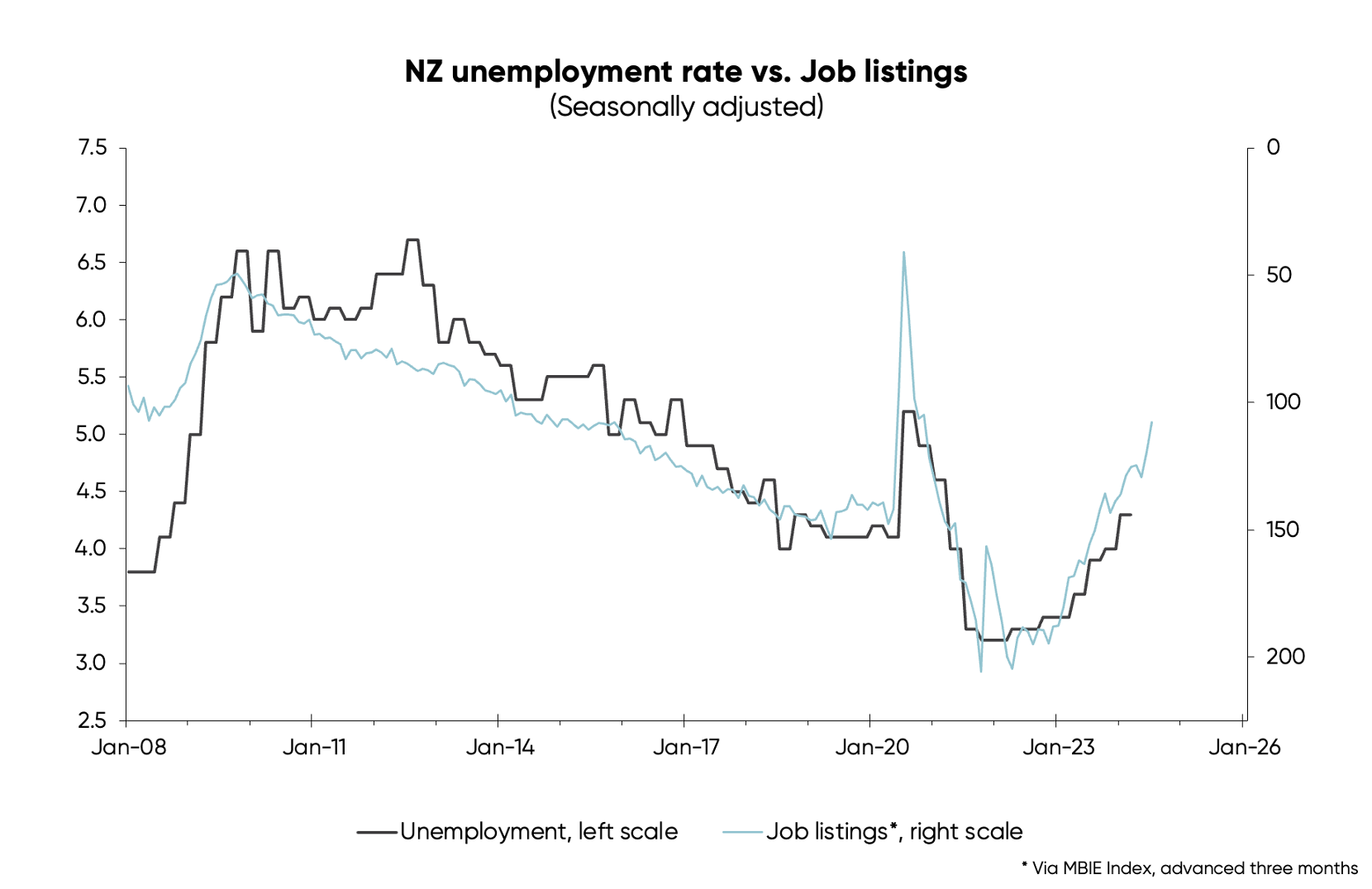

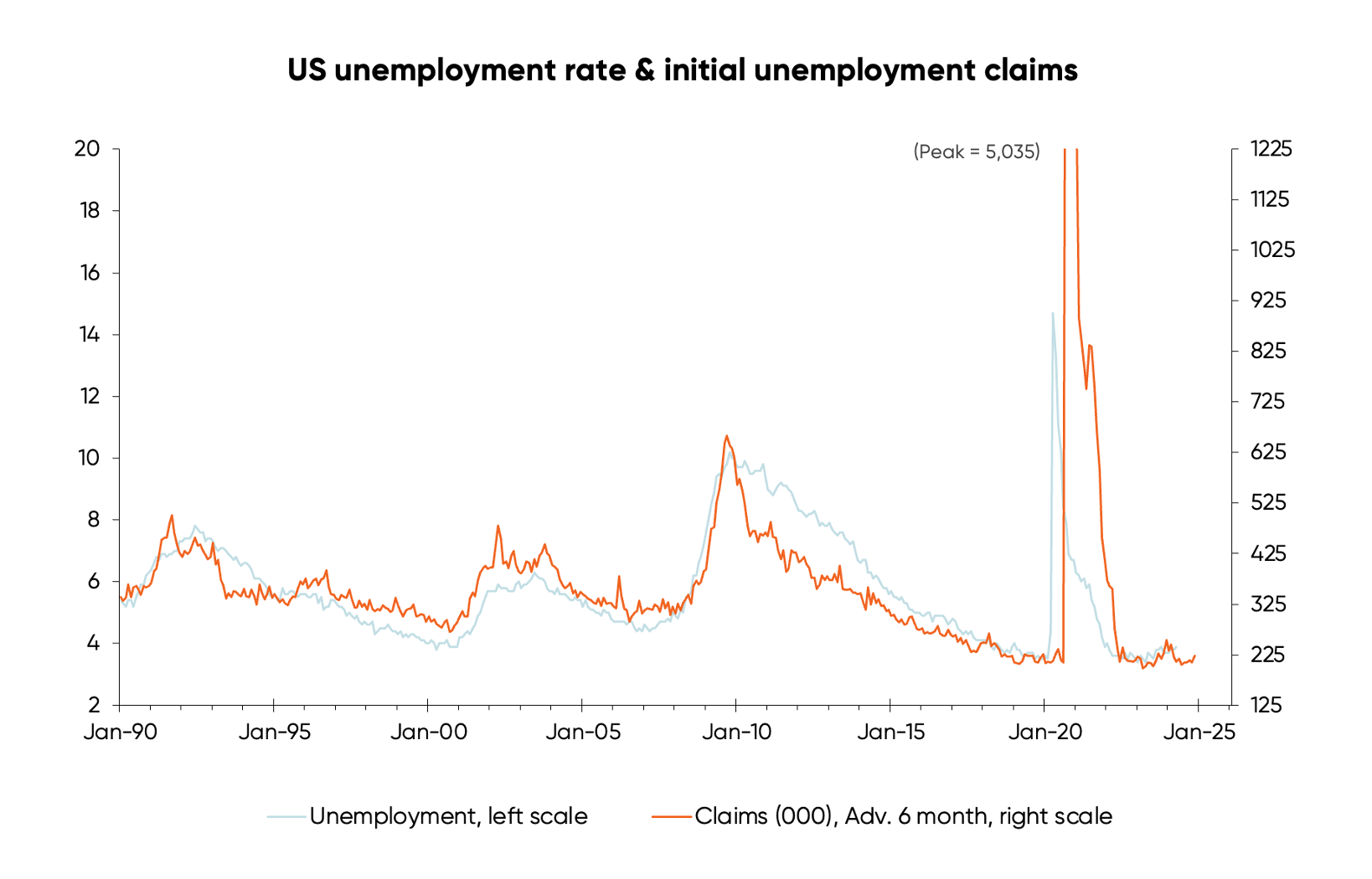

Critically, the much greater economic pain in NZ is reflected in not only the unemployment rate rising further here than that in the US but also in leading indicators pointing to the NZ rate rising much more in the near-term versus no upside for the US rate (fourth and fifth charts).

The implication is the Fed still has quite a bit of work to do to tame underlying inflation, while (with the much greater economic pain in NZ) the RBNZ should be much closer to getting the job done. It’s for that reason that NZ should see a fall in interest rates ahead of the US, due to its much more favourable underlying inflation outlook—which will be recognised first by the market and then belatedly by the RBNZ.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.